Insider

Trading and White Collar

Crime

Story

Written by Rick Archer

October 2014

While we cover our

mouths in horror at the evils of criminals and organized crime, I

don't think anyone would argue that the behavior of many businessmen

is any less corrupt.

"My father used to

always say to me that, you know, if a guy goes out to steal a

loaf of bread to feed his family, they'll give him 10 years, but

a guy can do white-collar crime and steal the money of thousands

and he'll get probation and a slap on the wrist." - - Jesse

Ventura

"The possibility of

bringing white-collar criminals to justice is ever receding over

the horizon." - - Sara Paretsky

The subject of "White

Collar Crime" is so vast that I can't do justice to the topic.

So I will limit myself to a few examples that are easy to understand

and hope I have said enough to make my point.

And what is my point?

•

Take sides. Neutrality helps the

oppressor, never the victim. Silence encourages the tormentor,

never the tormented.

-- Elie Wiesel, accepting the Nobel

Peace Prize

•

If

humanity does not opt for integrity, we are through completely. It is

absolutely touch and go. Each one of us could make the difference.

--

Buckminster Fuller

|

|

|

|

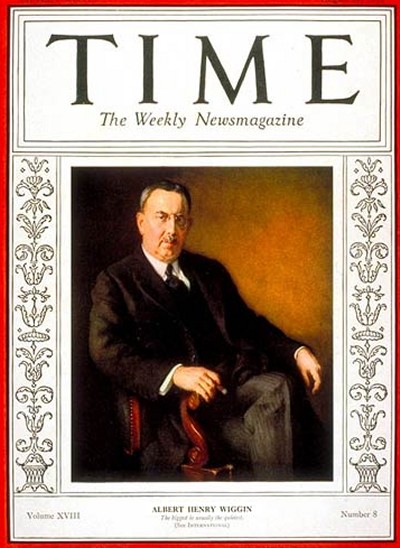

Albert H.

Wiggin

|

Albert Wiggin was the man who became a multi-millionaire during the

Wall Street crash of 1929. Mr. Wiggin wasn't your average

cheat. In fact, in certain circles he was a well-respected

man. You see, Albert Wiggin was the head of Chase National

Bank.

He didn't even go to to

jail for his cheating. What he did was perfectly legal.

During the Roaring '20s,

many Wall Street professionals, and even some of the general public,

knew Wall Street was a rigged game run by powerful investing pools.

Suffering from a lack of

disclosure and an epidemic of manipulative rumors, people believed

coattail investing and momentum investing were the only viable

strategies for getting in on the profits. Unfortunately, many

investors found that the coattails they were riding were actually

smokescreens for hidden sell orders that left them holding the bag.

Still, while the market kept going up and up, these setbacks were

seen as a small price to pay in order to get in on the big game

later on. In October, 1929, the big game was revealed to be yet

another smokescreen.

After the crash, the public was hurt, angry, and hungry for

vengeance. Albert H. Wiggin, the respected head of Chase National

Bank, seemed an unlikely target until it was revealed that he

shorted 40,000 shares of his own company. This is like a boxer

betting on his opponent – a serious conflict of interest.

Using wholly-owned family corporations to hide the trades, Wiggin

built up a position that gave him a vested interest in running his

company into the ground. There were no specific rules against

shorting your own company in 1929, so Wiggin legally made $4 million

from the 1929 crash and the shakeout of Chase stock that followed. (source)

Not only was this legal

at the time, but Wiggin had also accepted a $100,000 a year pension

for life from the bank. He later declined the pension when the

public outcry grew too loud to ignore. Wiggin was not alone in his

immoral conduct, and similar revelations led to a 1934 revision of

the 1933 Securities Act that was much sterner toward insider

trading. It was appropriately nicknamed the "Wiggin Act".

|

Albert Henry

Wiggin is our poster boy for the Myth of Business Ethics

|

|

|

|

|

|

Martha

Stewart

|

|

On the cover of the May 1995 issue, New

York Magazine declared her "the definitive American woman of our

time".

Ten years later she was convicted of

insider trading. Despite a net worth of $700 million at the

time, Stewart jeopardized everything to save $45,000.

Due to her

prominence, Martha Stewart became the poster girl for insider

traders who get

caught.

Despite the window

dressing of the "Wiggin Act" and many other laws like it, "Insider

Trading" goes on and on whether we like to admit it or not. The

story of Martha Stewart's insider trading is not important because

it was remarkable.

Just the opposite. Stories similar to

Martha Stewart happen to lesser-known people all the time.

Stewart's story is important because it hints at just how

commonplace insider trading is.

What we don't know is

how easy it is to get away with it because we lack statistics on the

frequency of successful cheating. Instead all we have are the

sordid tales of the ones who got caught.

So what happened?

In December 2001, the Food and Drug Administration (FDA) gave news

to ImClone CEO Samuel Waksal

that it was rejecting ImClone's new cancer drug, Erbitux.

Since the

drug represented a major portion of ImClone's pipeline, Waksal knew the

company's stock was about to take a sharp dive.

Many pharmaceutical

investors were hurt by the drop, but oddly enough, the family and friends of ImClone CEO Samuel Waksal

were not among them.

Among those with a preternatural knack for guessing the FDA's

decision days before the announcement was homemaking guru Martha

Stewart. She sold 4,000 shares when the stock was still trading in

the high $50s and collected nearly $250,000 on the sale. The

timing was absolutely perfect. The stock

would plummet to just over $10 in the following months.

Stewart claimed to have a pre-existing sell order with her broker,

but her story continued to unravel. Perhaps Stewart thought

her lawyers would find a loophole because in public she seemed to

treat the whole thing as a joke.

|

The best example of her

cavalier attitude came on national TV on 25 June 2002. CBS

anchor Jane Clayson grilled Stewart on the air about ImClone during

Stewart's regular segment on The Early Show. Stewart didn't bat an

eyelash. She continued chopping cabbage and famously quipped,

"I just want to focus on my salad".

However, any way Stewart

tossed her salad, this problem

wasn't going away. Public shame eventually forced her to

resign as the CEO of her own company, Martha Stewart Living Omnimedia.

Stewart was sentenced to

the minimum of five months in prison and fined $30,000. In

August 2006, the SEC announced that it had agreed to settle the

related civil case against Stewart. Under the settlement, Stewart

agreed to disgorge $58,062 (including interest from the losses she

avoided), as well as a civil penalty of three times the loss

avoided, or $137,019.

So how did Stewart get

caught?

Immunologist Sam Waksal

founded ImClone in 1984. The New York-based biotech firm remained

relatively unknown until 1999, when it announced the creation of

Erbitux — a cancer-fighting drug so promising it convinced

pharmaceutical giant Bristol-Myers to purchase $1 billion of ImClone

stock in one of the largest biotechnology partnerships in U.S.

history.

But when the Food and

Drug Administration rejected the drug, Waksal alerted several

relatives and friends to dump their stock as soon as possible —

before the FDA's decision had been made public.

Waksal's father and

daughter sold $9.2 million worth of ImClone, a move that caught the

attention of the SEC and eventually led to his arrest.

In retrospect, Waksal had made a rash and highly

foolish move. His action was not only highly illegal, it stuck

out like a red flag.

Martha Stewart's

situation was more complicated. Although Stewart was a friend

of Sam Waksal, he had actually done nothing to tip Stewart off personally. Waksal had not spoken to Stewart at all day.

What happened was that

Stewart and Waksal used the same Merrill Lynch stockbroker, Peter

Bacanovic. Although neither Bacanovic nor his assistant, Doug

Faneuil, knew about the Erbitux decision, both men could see plain as

day that Waksal was trying to dump his stock.

When Bacanovic arrived

at the office on the fateful morning, his assistant Doug Faneuil

told Bacanovic about a flurry of selling by the Waksal family that

morning. Even though they didn't

know 'why' Waksal was dumping stock, they could read the warning

signals. Something was badly wrong over at ImClone.

Bacanovic turned to Faneuil and blurted: "Oh my God, get Martha on

the phone."

On their advice, Stewart

promptly sold all her shares at the highest possible price before

the big plunge kicked in the following day.

Martha Stewart was not

caught directly. It was Sam Waksal who was caught red-handed.

And since Bacanovic was both Waksal and Stewart's broker,

Bacanovic's involvement is what indirectly led the investigators

onto Stewart's trail.

Strangely enough,

although what Stewart had done was unethical, it probably was on the

borderline of being legal. Technically speaking, Stewart had

merely traded on a tip passed on by her stockbroker. That is

what investors do all the time - follow the advice of their

stockbroker.

Insider trading is only

illegal when a person bases their trade of stocks in a public

company on information that the public does not know. It is illegal

to trade your own stock in a company based on this information but

it is also illegal to give someone that information, a tip, so they

can trade their stock. Stewart had not traded stock in her own

company. Nor had she been informed by Sam Waksal. That

put her into a gray area of sorts.

However, Stewart also

knew Bacanovic had breached his duty as a broker when he told her

about Waksal’s trades. In other words, she knew full well what she was

doing was wrong. Seeing how Bacanovic had put 2 and 2 together

and made a clever deduction, she expected to fly under the radar.

What happened instead is

that

Still, had she come

clean at the start, Stewart would have likely gotten away with a

wrist slap and a fine. Stewart actually caused her own demise

by lying about what she knew.

The nuances in Stewart’s case ultimately drove the government to

back down from charging her with insider trading. Instead, it

focused its case on the lies she told to cover the trade. When

questioned by the SEC and the FBI in the months following her trade,

Stewart said she had no knowledge of Waksal’s trade and that she had

sold on a standing agreement with her broker to sell if shares

traded below $60. Bacanovic corroborated the story, but his

assistant Faneuil eventually came forward and revealed the truth,

furthering the case against Stewart. Later, Stewart’s own assistant,

Annie Armstrong, testified that Stewart had tried to change a record

of Bacanovic’s phone message to her about ImClone.

Some people consider it

beyond amazing that Stewart was able to resurrect her career

following her release from prison.

Scott Turow is a

well-known author of fiction involving legal cases. His

comments on Stewart's behavior goes right to the point.

What the jury felt

Martha Stewart did -- lying about having received inside

information before she traded -- is wrong, really wrong. And the

fact that so many on Wall Street have unashamedly risen to her

defense is galling -- galling because what she did actually

harms the market. Wall Street leaders should be expressing

chagrin that a corporate tycoon -- who was also a member of the

New York Stock Exchange board -- could feel free to fleece an

unwitting buyer.

Virtually everybody who takes Ms. Stewart's side conveniently

ignores the fact that there was some poor schmo (or schmoes) out

there who bought her shares of ImClone.

Those buyers, no

matter how diligent, no matter how much market research they

read, no matter how many analysts' reports they studied, could

not have known what Martha Stewart did: that the Waksal family

was dumping shares. In my book, that's fraud.

Martha Stewart

ripped her buyers off as certainly as if she'd sold them silk

sheets that she knew were actually synthetic.

In addition to being fraud, her actions were also a type of

theft. She didn't learn about the Waksals and ImClone by

overhearing idle talk on an elevator. According to Mr. Faneuil's

testimony, he (under Mr. Bacanovic's orders) gave her the

confidential information that was supposed to have stayed within

the walls of their firm, Merrill Lynch. Stewart had to know

she was in possession of confidential information she had no

right to have, and by trading on it, she was a clear accessory

to the Merrill employees' misappropriation of it.

It's true that Martha Stewart was not accused of securities

fraud for selling her ImClone stock, because, the prosecutors

said, historically no one else had been charged criminally with

insider trading in similar circumstances. But Martha Stewart

didn't make false statements to a federal agency because she

thought her conduct in the sale was blameless. She did it to

cover her tracks.

Furthermore, the

right response to those Wall Streeters who point out that she

was not indicted for insider trading is to ask, why not?

Why would any sane person want to buy stock if Wall Street

bigwigs can palm off shares that they know, on the basis of

secret information, are about to nose dive?

What is wrong with

our laws that such obvious misconduct can't be charged

criminally?

-- Scott Turow

(source)

|

|

| |

|

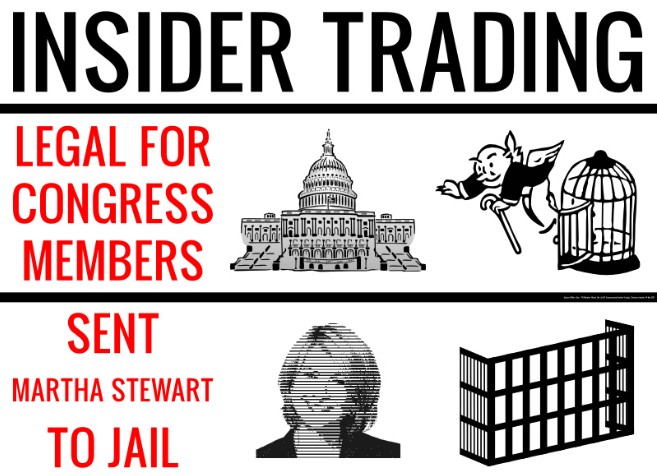

The 60

Minutes Segment About Congressional Insider Trading

Rick Archer's Note:

Do you know what an

'oxymoron' is? No, it is not another name for an idiot

Congressman. An oxymoron is a figure of speech in which

apparently contradictory terms appear in conjunction.

We are going to explore

the concept of "honest graft". Now those are two words

I never expected to see side by side.

According to the SEC,

trading stocks based on advance knowledge of action in Congress is

not considered 'insider trading'.

Others disagree. According to the Washington-based consumer

rights advocacy group Public Citizen, if one takes a look at the

statistics, members of Congress are either geniuses when it comes to

stock trading or they are in fact trading off of some of this

insider information.

Several published studies have implied that members of Congress are

in fact profiting from insider information.

A pair of 2011 academic studies found that House members beat the

market in their personal stock trading by about 6 percent. The

Senators did even better. They beat the market by about 10

percent.

A 2011 study entitled Abnormal Returns from the Common Stock

Investments of Members of the U.S. House of Representatives analyzed

16,000 common stock transactions made by around 300 House delegates

between 1985 and 2001. The study revealed

the findings of four university professors that a portfolio

replicating the purchases of House members beat the market by 55

basis points per month, or six percent annually. It also found that purchases made by

Democrats outperformed those of Republicans.

Then one day 60

Minutes got wind of these findings.

On a personal note,

I can't believe I missed

a story as incredible as this one, but I guess I was busy at the

time. However, when I saw this story as I did research, my

mouth fell wide open. I was stunned to discover it is

perfectly legal for Congressman to exploit the inside knowledge they

are privy to for their own personal gain.

You don't believe me?

Well, read on.

|

Back in 2011, Steve

Kroft of the CBS news program 60 Minutes uncovered a doozy of

a story... yes, indeed, it really is LEGAL for Congressmen to engage

in Insider Trading.

In 2006, Democratic

Representatives Louise Slaughter and Tim Walz introduced the

STOCK Act (Stop Trading On Congressional Knowledge). This

legislation was intended to stop members of Congress from benefiting

from insider knowledge of stocks.

The legislation went

nowhere.

It was placed on the congressional backburner — that

is, until it was featured on CBS's 60 Minutes. The 60 Minutes

episode which aired on Sunday, November 13, 2011, created a

firestorm of protest.

Overnight the bill garnered a significant number of co-sponsors in the Congress.

By the following Friday, the number of co-sponsors of the bill had

shot from 9 to 91. President Obama would

sign the Stock Act into law on 4 April 2012.

|

|

| |

|

Transcript of

Steve Kroft's Insider Trading Episode

(source)

The following is a script

of "Insiders" which aired on 13 November 2011.

Steve Kroft was the correspondent, Ira Rosen and Gabrielle Schonder

were the

producers.

|

Introduction

Steve Kroft reports that

members of Congress can legally trade stock based on non-public

information from Capitol Hill

Washington, D.C. is a town that runs on inside information - but

should our elected officials be able to use that information to pad

their own pockets?

As Steve Kroft reports,

members of Congress and their aides have regular access to powerful

political intelligence, and many have made well-timed stock market

trades in the very industries they regulate. For now, the practice

is perfectly legal, but some say it's time for the law to change.

The next national election is now less than a year away and

congressmen and senators are expending much of their time and their

energy raising the millions of dollars in campaign funds they'll

need just to hold onto a job that pays $174,000 a year.

Few of them are doing it for the salary and all of them will say

they are doing it to serve the public. But there are other benefits:

Power, prestige, and the opportunity to become a Washington insider

with access to information and connections that no one else has, in

an environment of privilege where rules that govern the rest of the

country, don't always apply to them.

It has long been

suspected that most former congressmen and senators manage to leave Washington

- if they ever leave Washington at all - with more money in their

pockets than they had when they arrived.

As you are about to

see, the biggest challenge is often avoiding temptation.

Honest Graft -

Steve

Kroft

Interview with Peter Schweizer

|

Peter Schweizer

is a fellow at the Hoover Institution, a conservative think

tank at Stanford University.

A year ago he

began working on a book about soft corruption in Washington

with a team of eight student researchers, who reviewed

financial disclosure records.

It became a

jumping off point for our own story, and we have

independently verified the material we've used.

Schweizer says he wanted to know why some congressmen and

senators managed to accumulate significant wealth beyond

their salaries, and proved particularly adept at buying

and selling stocks.

Peter

Schweizer: This is a venture opportunity.

This is an

opportunity to leverage your position in public service

and use that position to enrich yourself, your friends,

and your family.

|

|

Peter Schweizer:

There are all sorts of forms of honest graft that

congressmen engage in that allow them to become very, very

wealthy. So it's not illegal, but I think it's highly unethical,

I think it's highly offensive, and wrong.

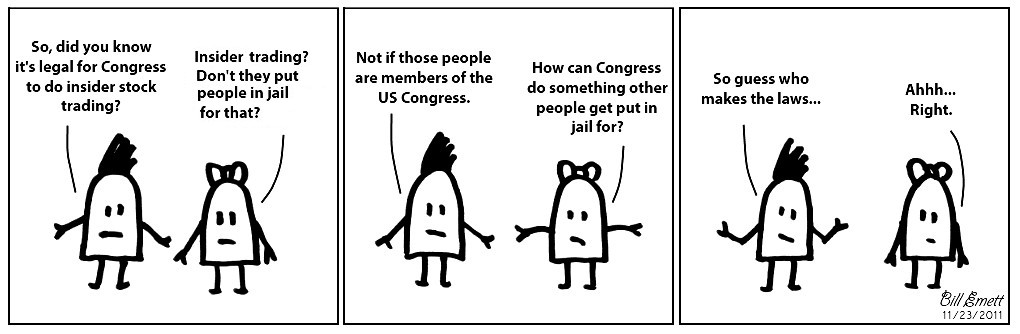

Steve Kroft: What do you mean by 'honest graft'?

Schweizer: For example insider trading on the stock

market. If you are a member of Congress, those laws are deemed

not to apply.

Kroft: So congressman get a pass on insider trading?

Schweizer: They do. The fact is, if you sit on a

healthcare committee and you know that Medicare, for example,

is-- is considering not reimbursing for a certain drug that's

market moving information. And if you can trade stock on-- off

of that information and do so legally, that's a great profit

making opportunity. And that sort of behavior goes on.

Kroft: Why does Congress get a pass on this?

Schweizer: It's really the way the rules have been

defined. And the people who make the rules are the political

class in Washington. And they've conveniently written them in

such a way that they don't apply to themselves.

The buying and selling

of stock by corporate insiders who have access to non-public

information that could affect the stock price can be a criminal

offense, just ask hedge fund manager Raj Rajaratnam who recently got

11 years in prison for doing it.

But, congressional lawmakers have no corporate responsibilities and

have long been considered exempt from insider trading laws, even

though they have daily access to non-public information and plenty

of opportunities to trade on it.

Schweizer: We

know that during the health care debate people were trading

health care stocks. We know that during the financial crisis of

2008 they were getting out of the market before the rest of

America really knew what was going on.

Spencer

Bachus

In mid September 2008

with the Dow Jones Industrial average still above ten thousand,

Treasury Secretary Hank Paulson and Federal Reserve Chairman Ben

Bernanke were holding closed door briefings with congressional

leaders, and privately warning them that a global financial meltdown

could occur within a few days. One of those attending was Alabama

Representative Spencer Bachus, then the ranking Republican

member on the House Financial Services Committee and now its

chairman.

Schweizer:

These meetings were so sensitive-- that they would actually

confiscate cell phones and Blackberries going into those

meetings. What we know is that those meetings were held one day

and literally the next day Congressman Bachus would engage in

buying stock options based on apocalyptic briefings he had the

day before from the Fed chairman and treasury secretary. I mean,

talk about a stock tip.

While Congressman Bachus was

publicly trying to keep the economy from cratering, he was

privately betting that it would, buying option funds that would

go up in value if the market went down. He would make a variety

of trades and profited at a time when most Americans were losing

their shirts.

Rick Archer's Note:

In the interest of fairness, I took a look at what Wikipedia

had to say about Spencer Bachus.

In

2007, Bachus was falsely accused of insider trading.

He

was subsequently cleared by the Office of Congressional

Ethics. The Congressional Ethics inquiry stemmed from an

allegation by Peter Schweizer and later reported by

60 Minutes that Bachus made trades with a number of

short term stock options, betting that stocks would rise

or fall for a quick profit or loss.

Schweizer claimed that from July through November 2008,

Bachus traded in options at least forty times. During

this period, Bachus was one of the Congressional leaders

getting private briefings from Secretary of the Treasury

Hank Paulson and Federal Reserve Bank Chairman Ben

Bernanke about the worsening financial crisis.

Bachus said that he "never trades on non public

information, or financial services stocks".

On

April 30, 2012 the Office of Congressional Ethics

announced that they had found no evidence of violations

of insider-trading rules and recommend that the case

against him be closed.

Roderick Hills and Harvey Pitt, former Chairmen of the

Securities and Exchange Commission who reviewed the

accusations, wrote "the original source for these

allegations was a sensational, but factually inaccurate,

book, followed by an adulatory (but equally inaccurate)

'60 Minutes' segment about it. The allegations in the

book, vis-à-vis Mr. Bachus, are inaccurate; far worse,

however, is that these allegations are laughable to

serious students of insider trading law."

Wikipedia

Congressman Bachus

declined to talk to us, so we went to his office and ran into his

Press Secretary Tim Johnson.

Kroft: Look

we're not alleging that Congressman Bachus has violated any

laws. All...the only thing we're interested in talking to him is

about his trades.

Tim Johnson: Ok...Ok that's a fair enough request.

What we got was a

statement from Congressman Bachus' office that he never trades on

non-public information, or financial services stock. However, his

financial disclosure forms seem to indicate otherwise. Bachus made

money trading General Electric stock during the crisis, and a third

of GE's business is in financial services.

John

Boehner

During the healthcare debate of 2009, members of Congress were

trading health care stocks, including House Minority Leader John

Boehner, who led the opposition against the so-called public option,

government funded insurance that would compete with private

companies. Just days before the provision was finally killed off,

Boehner bought health insurance stocks, all of which went up. Now

speaker of the House, Congressman Boehner also declined to be

interviewed, so we tracked him down at his weekly press conference.

Kroft: You made a number of

trades going back to the health care debate. You bought some

insurance stock. Did you make those trades based on non-public

information?

John Boehner: I have not made any decisions on day-to-day

trading activities in my account. And haven't for years. I

don't-- I do not do it, haven't done it and wouldn't do it.

(Republican

Speaker John Boehner's office would later call his inclusion

into this 60 Minutes story "idiotic.")

Later Boehner's

spokesman told us that the health care trades were made by the

speaker's financial adviser, who he only consults with about once a

year.

Peter Schweizer: We need to

find out whether they're part of a blind trust or not.

Peter Schweizer thinks

the timing is suspicious, and believes congressional leaders should

have their stock funds in blind trusts.

Schweizer:

Whether it's uh-- $15,000 or $150,000, the principle in my mind

is that it's simply wrong and it shouldn't take place.

But there is a long history of self-dealing in Washington. And

it doesn't always involve stock trades.

Dennis

Hastert

Congressmen and senators also seem to have a special knack

for land and real estate deals. When Illinois Congressman Dennis

Hastert became speaker of the House in 1999, he was worth a few

hundred thousand dollars.

He left the job eight years later a

multi-millionaire.

Jan Strasma: The road that

Hastert wants to build will go through these farm fields right

here.

In 2005, Speaker Hastert

got a $207 million federal earmark to build the Prairie Parkway

through these cornfields near his home. What Jan Strasma and his

neighbors didn't know was that Hastert had also bought some land

adjacent to where the highway is supposed to go.

Strasma: And five months

after this earmark went through Hastert sold that land and made

a bundle of money.

Kroft: How much?

Strasma: Two million dollars.

Kroft: What do you think of it?

Strasma: It stinks.

We stopped by the former

speaker's farm, to ask him about the land deal, but he was off in

Washington where he now works as a lobbyist. His office told us that

property values in the area began to appreciate even before the

earmark and that the Hastert land was several miles from the nearest

exit.

Judd

Gregg

The same good fortune befell former New Hampshire Senator Judd

Gregg. Gregg helped steer nearly $70 million dollars in government

funds towards redeveloping this defunct Air Force base, which he and

his brother both had a commercial interest in. Gregg has said that

he violated no congressional rules.

Nancy Pelosi

Gregg's good fortune is but one more

example of good things happening to powerful members of Congress. Another is the access to initial public stock offerings

(IPOs), the

opportunity to buy a new stock at insider prices just as it goes on

the market. IPOs can be incredibly lucrative and hard to get.

Schweizer: If

you were a senator, Steve, and I gave you $10,000 cash, one or

both of us is probably gonna go to jail. But if I'm a corporate

executive and you're a senator, and I give you IPO shares in

stock and over the course of one day that stock nets you

$100,000, that's completely legal.

Former House Speaker

Nancy Pelosi and her husband have participated in at least eight

IPOs. One of those came in 2008, from Visa, just as a troublesome

piece of legislation that would have hurt credit card companies,

began making its way through the House. Undisturbed by a potential

conflict of interest the Pelosis purchased 5,000 shares of Visa at

the initial price of $44 dollars. Two days later it was trading at

$64. The credit card legislation never made it to the floor of the

House.

Congresswoman Pelosi also declined our request for an interview, but

agreed to call on us if we attended a news conference.

Kroft: Madam

Leader, I wanted to ask you why you and your husband back in

March of 2008 accepted and participated in a very large IPO deal

from Visa at a time there was major legislation affecting the

credit card companies making its way through the-- through the

House.

Nancy Pelosi: But--

Kroft: And did you consider that to be a conflict of

interest?

Pelosi: The-- y-- I-- I don't know what your point is of

your question. Is there some point that you want to make with

that?

Kroft: Well, I-- I-- I guess what I'm asking is do you

think it's all right for a speaker to accept a very

preferential, favorable stock deal?

Pelosi: Well, we didn't.

Kroft: You participated in the IPO. And at the time you

were speaker of the House. You don't think it was a conflict of

interest or had the appearance--

Pelosi: No, it was not--

Kroft: --of a conflict of interest?

Pelosi: --it doesn't-- it only has appearance if you

decide that you're going to have-- elaborate on a false premise.

But it-- it-- it's not true and that's that.

Kroft: I don't understand what part's not true.

Pelosi: Yes sir. That-- that I would act upon an

investment.

Congresswoman Pelosi pointed out that

the tough credit card legislation eventually passed, but it was two

years later and was initiated in the Senate.

Pelosi: I

will hold my record in terms of fighting the credit card

companies as speaker of the House or as a member of Congress up

against anyone.

(Democratic

Congresswoman Nancy Pelosi's office would later call this

60 Minutes

report a "right-wing smear.")

Corporate executives, members of the executive branch and all

federal judges are subject to strict conflict of interest rules. But

not the people who write the laws.

Peter Schweizer: If

you are a member of Congress and you sit on the defense

committee, you are free to trade defense stock as much as you

want. If you're on the Senate banking committee you can trade

bank stock as much as you want. This practice regularly goes on

in all these committees.

Brian Baird

Brian Baird is a former

congressman from Washington state who served six terms in the house

before retiring last year. He spent half of those 12 years trying to

get his colleagues to prohibit insider trading in Congress and

establish some rules governing conflicts of interest.

Brian Baird:

There should only be one thing in your mind when you're drafting

legislation, 'Is this good for the United States of America?'

That's it. If you're starting to say to yourself 'how's this

going to affect my investments,' you've got-- you've got a mixed

agenda and a mixed purpose for being there.

Baird: One line in a bill in Congress can be worth

millions and millions of dollars. There was one night, we had a

late, late night caucus and you could kind of tell how a vote

was going to go the next day. I literally walked home and I

thought, 'Man, if you-- if you went online and made some

significant trades, you could make a lot of money on this.'

You could just see it. You could see the potential here

to get rich.

So in 2004, Baird and

Congresswoman Louise Slaughter introduced the Stock Act which would

make it illegal for members of Congress to trade stocks on

non-public information and require them to report their stock trades

every 90 days instead of once a year.

Kroft: How

far did you get with this?

Baird: We didn't get anywhere. Just flat died. Went

nowhere.

Kroft: How many cosponsors did you get?

Baird: I think we got six.

Kroft: Six doesn't sound like a very big amount.

Baird: It's not, Steve. You could have 'National

Cherry Pie Week' and get 100 cosponsors at the drop of a hat.

When Brian Baird finally managed to get a congressional hearing on the

Stock Act, almost no one showed up. Since then, the Stock Act

is reintroduced every session,

but is buried so deep in the Capitol we had trouble finding

congressmen who had even heard of it.

[Rick Archer's Note:

At this point, Steve Kroft attempted to buttonhole various

members of Congress. Here were their reactions.]

Kroft: Have

you ever heard of the Stock Act?

Steve Palazzo: The what?

Kroft: The Stock Act. Do you know anything about it?

Congressman Palazzo: No.

Kroft: Congressman Quayle, have you ever heard of the

Stock Act?

Congressman Quayle: I haven't heard about that one yet.

Kroft: Congressman Watt, have you ever heard of something

called the Stock Act?

Congressman Watt: No.

Male voice: I've heard about it, but not much. I can't

say it's an issue I've spent a lot of time on.

Another Male voice: I would have no problem with that.

Kroft: Okay.

Male voice: But then again I am a big fan of, you know,

instant disclosure on almost everything.

Kroft: They're looking for co-sponsors.

Male voice: And yet, I've never heard of it.

Baird: When you have a bill

like this that makes so much sense and you can't get the

co-sponsorships, you can't get the leadership to move it, it

gets tremendously frustrating. Set aside that it's the right

thing to do, it's good politics. People want their Congress to

function well. It still baffles me.

But what baffles Baird

even more is that the situation has gotten worse. In the past few

years a whole new totally unregulated, $100 million dollar industry

has grown up in Washington called Political Intelligence.

'Political Intelligence' employs former

congressmen and former staffers to scour the halls of the Capitol

gathering valuable non-public information in a manner akin to mining

for nuggets of gold. These "miners" then turn around and sell

their information to hedge

funds and traders on Wall Street who can trade on it.

Baird: Now if

you're a political intel guy, you get that information long

before it's public. Long before somebody wakes up the next

morning and reads or watches the television or whatever, you've

got it.

And you can make

real-time trades before anybody else.

Baird says "political

intelligence" has taken

what would be a criminal enterprise anyplace else in the country and

turned it into a profitable business model.

Baird: The

town is all about people saying-- what do you know that I don't

know. This is the currency of Washington, D.C. And it's that

kind of informational currency that translates into real

currency. Maybe it's over drinks maybe somebody picks up a

phone. And says you know just to let you know it's in the bill.

Trades happen. Can't trace 'em.

If you can't trace 'em,

it's not illegal. It's a pretty great system. You feel like an

idiot to not take advantage of it.

|

White Collar Crime

It is depressing to know

that all walks of life are rife with cheaters.

|

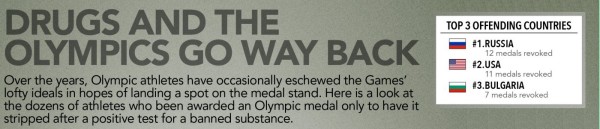

As much as we like to

point fingers at the Russians, American athletes are no strangers to

cheating. Think "Lance Armstrong", "Marion Jones", and

steroids in baseball. Nevertheless, even in this arena, we can

shrug our shoulders and still go on to enjoy our lives. Some people

even begin to take sports less seriously.

|

|

|

|

|

We also know that there

are people who taking cheating at cards and dice to the level of art

form.

Why not mark your cards

with a special dye that only your special contact lens or sunglasses

is able to see?

Wouldn't it be fun to

seem so damn smart?

It is one thing to lose

to a cheater at Scrabble, Bridge, or Chess, even at the highest

levels.

Fortunately, unless we

make a living at games, most of us can live with the experience and still go

on to lead comfortable lives.

|

|

|

|

|

However, when it comes to

cheating in other areas of our lives such as business and medicine,

this kind of corruption affects all of us in profound ways.

Many years ago, upon my

stockbroker's advice, I invested practically my entire savings in

oil stocks. This was back in the early Eighties.

I saw practically my entire investment go down the

drain when the price of oil plummeted drastically.

As it turned out, the

perilous downfall was due to a serious surplus of crude oil caused

by falling demand following the 1970s Energy Crisis.

This

resulted in an enormous oil glut. The world price of oil,

which had peaked in 1980 at over US$35 per barrel ($100 per barrel

today), fell in 1986 from $27 to below $10.

During the oil crisis,

my stockbroker advised me to sell and cut my losses. So that's

what I did. I noticed he made commissions on the sale of these

ruined stocks as well. Hmm.

The stockbroker gave me

lousy advice, yet he made money on the purchase of the oil stocks

and he made money on the sale of oil stocks. He cleaned up and

I was wiped out.

It didn't seem right

that this incompetent broker made money while I was losing it based

on his recommendation.

No other profession that

I can think of rewards losers so consistently.

All I got from my

stockbroker in return was an apology and a valuable lesson - this

investment game is for people who take it very seriously, not for

the average guy like me.

I concluded there are

people out there who know far too many things I do not and that this

advantage would always doom me to remain in the loser's bracket.

I have never invested another dime in the stock market.

This decision has

allowed me to watch scandals like Enron, the Savings and Loan

fiascos, the 2008 collapse of Wall Street, and the existence of

morally-bereft monsters like Bernie Madoff with the equanimity that

can only come from not having my own ass on the line.

While I have not

suffered direct consequences from these events, I have watched in

sadness as other people's lives were ruined.

|

Back in the

Eighties, no doubt somebody knew that there was a coming oil

surplus, but it wasn't me. I was one of the "schmoes" who paid

the price of ignorance.

Something the

average American doesn't know is there were people in watchdog

positions who were tipped off about Madoff on several occasions but

did nothing. The individual who brought Madoff down - Harry

Markopolos - stated he believed Madoff was 'protected' by someone

very high in government.

|

|

|

The Victims

of Enron

|

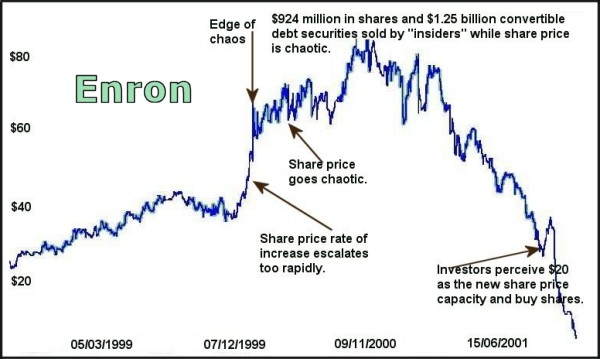

The

stunning collapse of the once-mighty Enron Corp. was a disaster for

thousands of workers. The fiasco wiped out 12,000 employees

retirement savings and cost 5,000 workers their jobs.

Meanwhile Enron executives scandalously lined their own pockets and

made millions while game-facedly lying to employees and shareholders

alike.

Employees' Retirement Plan Is a Victim as

Enron Tumbles

By RICHARD A. OPPEL Jr.

New York Times (source)

Published: November 22, 2001

The

rapid decline of the Enron Corporation has devastated its

employees' retirement plan, which was heavy with company stock,

and has infuriated workers, who were prohibited from changing

their investments as the stock plunged.

Through the 401(k) retirement plan, employees chose to put much

of their savings in Enron shares, and the company made

contributions in company stock as well. But around the time

Enron disclosed serious financial problems last month, the

company froze the assets in the plan because of an

administrative change. For several weeks, as the stock lost much

of its value, workers stood by helplessly as their retirement

savings evaporated. They were not allowed to switch investments

at all -- even though the plan had far less risky choices.

The unfortunate timing caps a year of pain for Enron's workers.

At the end of last year, the 401(k) plan had $2.1 billion in

assets. More than half was invested in Enron, an energy

conglomerate. Since then, the stock has lost 94 percent of its

value.

At Portland General Electric, the Oregon utility acquired by

Enron four years ago, some workers nearing retirement have lost

hundreds of thousands of dollars. The utility has lined up grief

counselors to help them work through their problems.

''We had some married couples who both worked who lost as much

as $800,000 or $900,000,'' said Steve Lacey, an emergency-repair

dispatcher for Portland General. ''It pretty much wiped out

every employee's savings plan.''

''Shortly after it was frozen, the articles started coming out

about some of the questionable activities of Enron,'' Mr. Lacey

added. ''The stock took a tremendous drop, and we were pretty

much helpless.''

The loss serves as a grim reminder of the danger of relying too

heavily on one investment.

|

There

were crooks at Enron who cooked the books and deceived the stock

holders at every turn.

There were

executives at Enron who got out AHEAD of the collapse by cashing in

their stock options.

You don't

suppose they knew something, do you??

|

Rick Archer's Note:

I think Scott Turow said it the best. He made it clear that

when the cheats of the world get away with their insider trading

schemes, the average guy on the street is the one who pays.

• Virtually

everybody who takes Ms. Stewart's side conveniently ignores the

fact that there was some poor schmo (or schmoes) out there who

bought her shares of ImClone.

• Those buyers, no

matter how diligent, no matter how much market research they

read, no matter how many analysts' reports they studied, could

not have known what Martha Stewart did: that the Waksal family

was dumping shares. In my book, that's fraud.

• Martha

Stewart ripped her buyers off as certainly as if she'd sold them

silk sheets that she knew were actually synthetic.

• In addition to being fraud, her actions were also a type of

theft. She didn't learn about the Waksals and ImClone by

overhearing idle talk on an elevator. According to Mr. Faneuil's

testimony, he (under Mr. Bacanovic's orders) gave her the

confidential information that was supposed to have stayed within

the walls of their firm, Merrill Lynch. Stewart had to know

she was in possession of confidential information she had no

right to have, and by trading on it, she was a clear accessory

to the Merrill employees' misappropriation of it.

For

every cheater, there is a long line of victims.

What

Scott Turow is saying is that the "$45,000" that Martha Stewart

saved had to come out of someone's pocket. Various investors

who were completely ignorant of the behind-the-scenes drama at

ImClone unwittingly bought Martha Stewart's shares on ImClone.

And one day later, they gasped as the value of their shares

plummeted drastically.

What I worry about are the

victims. I worry about the people who know they are being shoved to the

back by the cheaters. For example, how many cyclists and how many

baseball players turned to drugs as the only way to stay even with the

competition?

And

how many people avoid the stock market like the plague?

What

this cheating does is make us all cynical. We don't trust the

stock market. We don't trust Wall Street. We don't

trust our politicians.

And we

don't trust our fellow man much either. That is the cost

of cheating... it makes us all believe that this is a dog eat dog

world where the worst behavior is rewarded and honesty is for chumps

and people too stupid to cheat.

As I grow older, I find it

saddening to observe what seems like the collapse of values in a

society. I see one TV show after another where the message is that the

fastest way to get ahead is to climb over the shoulders of the person in

front of them.

Why outwork somebody or be

more creative when you can cheat your way to the top?

And how many people on Wall

Street feel the need to cheat to keep up with the insider trading of

their competitors?

Personally speaking, I don’t

think believe that cheating is the correct path to happiness.

I believe in doing things the right way. I

think that real integrity is doing

things the right way even when no is looking.

However,

I also believe that I have to protect myself.

Many people in this world will cheat if

they think they can get away with it. These people

require external controls. They need to believe

they will be punished if they are caught. And they need to

believe that there is a good chance they are going to be caught.

To me, many of these stories reveal how the

honest people absolutely must work together to expose the cheaters.

Bernie Madoff, for example,

was exposed by a man who was once supremely chewed out by his boss for

underperforming vis a vis Madoff. The man, Harry Markopolos, was made

to feel ashamed because he was being beaten so badly. So Markopolos

decided to study Madoff closely and discover his secret.

And when Markopolos discovered the secret, to his dismay, it took ten years to

get anyone to believe him! And why did it

take so long?

Markopolos said that Madoff was being protected by people in

government. In other words, the cheaters watch out for the

cheaters.

And

that says it all. Our society has become split down the

middle... the honest people trying to defend themselves against

dishonesty in every walk of life.

As they always say, if you

look the other way and take the easy way out, then the cheats become

more confident. The problem is finding the guts to confront and defeat

the cheats before they get too powerful. If people speak up, then maybe

these jerks will think twice.

•

Take sides. Neutrality helps the

oppressor, never the victim. Silence encourages the tormentor,

never the tormented.

-- Elie Wiesel, accepting the Nobel

Peace Prize

•

In the bitter end, we will not

hear the words of our enemies, but the silence of our friends

-- Martin Luther King Jr.

•

In matters of conscience, the

law of majority has no place.

-- Mohandas K. Gandhi

•

It

is your karma to fight evil. It doesn't matter if the people

that evil is being committed against don't fight back. It

doesn't matter if the entire world chooses to look the other

way. Always remember this. You don't live with the consequences

of other people's karma. You live with the consequences of your

own

-- Hindu Proverb

•

First

they came for the socialists, and I did not speak out -- because

I was not a socialist. Then they came for the trade unionists,

and I did not speak out -- because I was not a trade unionist.

Then they came for the Jews, and I did not speak out -- because

I was not a Jew. Then they came for me -- and there was no

one left to speak for me.

--Attributed to Pastor Martin

Niemöller (1892–1984) about the cowardice of German

intellectuals following the Nazis' rise to power and the

subsequent purging of their chosen targets, group after

group.

•

If

humanity does not opt for integrity, we are through completely. It is

absolutely touch and go. Each one of us could make the difference.

--

Buckminster Fuller

Rick Archer

October 2014

rick@ssqq.com

|