Cancer

Diaries

Part Eight:

The Twisted Golden Rule

|

Written by

Rick Archer

January 2014

Many of us assume the

Golden Rule, "Do Unto Others As You Would Have Them do Unto

You", originated in the Christian faith.

Such is not the case.

A similar maxim appears in practically all the world's religions and

ethical traditions.

Considering just how

widespread this concept is across the world, what a shame the Golden

Rule is not observed more often.

There is a cynical

corollary to the Golden Rule that goes something like this:

"He Who

Owns the Gold Makes the Rules".

As you will read, this

twisted version of the Golden Rule completely explains why America

is stuck with one of the world's most mediocre health systems.

|

|

Keep in mind my "Cancer

Diaries" began as an

investigation into what seems to be the deliberate suppression of

several potential "alternative" cures

to cancer over the past century. Just the thought that

someone would deliberately deprive the human race of a remedy to

this dread scourge is difficult to accept, but I have come to

believe that is exactly what has happened.

During my research, I

have discovered the reprehensible action of deliberately

sabotaging promising cancers cures is just one

part of a widespread 'disease' that extends throughout America's

entire Medical Industry.

While I continue to

believe that America has many of the finest doctors, hospitals

and research facilities in the world, I am flabbergasted to

learn that health care in America has become far too expensive

for most of the people it was meant to serve. It isn't

just the poor who cannot afford to get sick, now the middle

class is just as terrified. 60% of all bankruptcies in

America today are related to the inability to pay for

catastrophic illnesses. One single illness can

effortlessly wipe out someone's entire life savings.

I am convinced that

the problems in finding a cure for cancer are actually just

another symptom of a medical system that is unbelievably

corrupt, ridiculously inefficient, and insanely profitable for

those "insiders" who benefit from rigging the game.

Let us begin our

look at the problems in American medicine with the following

story.

|

Our Broken American Medical

System

|

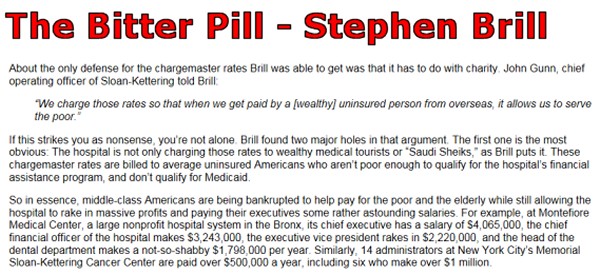

Why Medical Bills Are Killing Us

By Steven Brill, TIME Magazine

27 February

2013

|

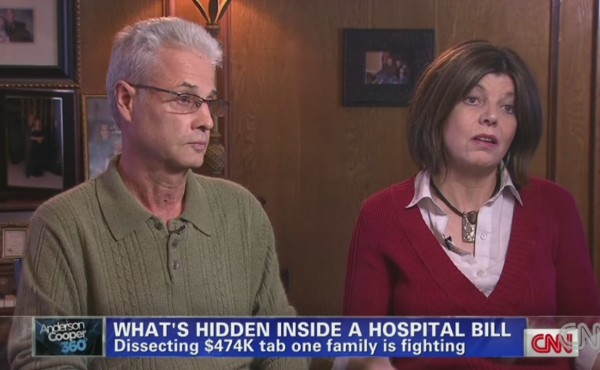

When Sean Recchi, a 42-year-old from

Lancaster, Ohio, was told in March

2012 that he had non-Hodgkin's lymphoma, his wife Stephanie

knew she had to get him to MD Anderson Cancer Center in Houston.

Stephanie's father had been treated there 10 years earlier, and she

and her family credited the doctors and nurses at MD Anderson with

extending his life by at least eight years.

Because Stephanie and her husband had recently started their own

small technology business, they were unable to buy comprehensive

health insurance. For $469 a month, or about 20% of their income,

they had been able to get only a policy that covered just $2,000 per

day of any hospital costs. "We don't take that kind of discount

insurance," said the woman at MD Anderson when Stephanie called to

make an appointment for Sean.

Stephanie was then told by a billing clerk that the estimated

cost of Sean's visit - just to be examined for six days so a

treatment plan could be devised - would be $48,900, due in advance.

Stephanie got her mother to write her a check. "You do anything you

can in a situation like that," she says.

The Recchis flew to Houston, leaving

Stephanie's mother to care for their two teenage children.

About a week later, Stephanie had to ask her mother for

$35,000 more so Sean could begin the treatment the doctors had

decided was urgent. His condition had worsened rapidly since he had

arrived in Houston. He was "sweating and shaking with chills and

pains," Stephanie recalls. "He had a large mass in his chest that

was ... growing. He was panicked."

Nonetheless, Sean was held for about 90 minutes in a reception

area, she says, because the hospital could not confirm that the

check had cleared. Sean was allowed to see the doctor only after he

advanced MD Anderson $7,500 from his credit card. The hospital says

there was nothing unusual about how Sean was kept waiting. According

to MD Anderson communications manager Julie Penne, "Asking for

advance payment for services is a common, if unfortunate, situation

that confronts hospitals all over the United States."

The total cost, up

front payable in advance, for Sean to get his treatment plan

and initial doses of chemotherapy was $83,900.

There was no insurance. This money would have to come out of

his pocket. Otherwise he could just go home and continue

dying.

The first of the 344 lines printed

out across eight pages of his hospital bill - filled with

indecipherable numerical codes and acronyms - seemed

innocuous.

Here is one

item. It read, "1 ACETAMINOPHE TABS 325 MG."

The charge was only $1.50, but it was for a generic

version of a Tylenol pill.

You can buy 100 of them on Amazon

for $1.49 even without a hospital's purchasing power...

in other words, a 100% markup. That set the tone for

all that followed.

Dozens of midpriced items were embedded with similarly

aggressive markups, like $283.00 for a "CHEST, PA AND LAT

71020." That's a simple chest X-ray, for which MD Anderson

is routinely paid $20.44 when it treats a patient on

Medicare, the government health care program for the

elderly.

Every time a nurse drew blood, a "ROUTINE VENIPUNCTURE"

charge of $36.00 appeared, accompanied by charges of $23 to

$78 for each of a dozen or more lab analyses performed on

the blood sample.

In all, the charges for blood and other

lab tests done on Recchi amounted to more than $15,000.

Had Recchi been old enough for

Medicare, MD Anderson would have been paid a few hundred

dollars for all those tests.

By law, Medicare's payments

approximate a hospital's cost of providing a service,

including overhead, equipment and salaries.

On the second page of the bill, the

markups got bolder. Recchi was charged $13,702 for "1

RITUXIMAB INJ 660 MG." That's an injection of 660 mg of a

cancer wonder drug called Rituxan. The average price paid by

all hospitals for this dose is about $4,000, but MD Anderson

probably gets a volume discount that would make its cost

$3,000 to $3,500. That means the nonprofit cancer center's

paid-in-advance markup on Recchi's lifesaving shot would be

about 400%.

When I asked MD Anderson to comment on the charges on

Recchi's bill, the cancer center released a written

statement that said in part, "The issues related to

health care finance are complex for patients, health care

providers, payers and government entities alike ... MD

Anderson's clinical billing and collection practices are

similar to those of other major hospitals and academic

medical centers."

The hospital's hard-nosed approach

definitely pays off. Although it is officially a

"nonprofit" unit of the

University of Texas, MD Anderson

is hardly a non-profit operation.

MD Anderson

has revenue that exceeds the cost of the world-class care it

provides by so much that its operating profit for the fiscal

year 2010, the most recent annual report it filed with the

U.S. Department of Health and Human Services, was $531

million.

That's a profit margin of 26% on

revenue of $2.05 billion, an astounding result for such a

service-intensive enterprise.

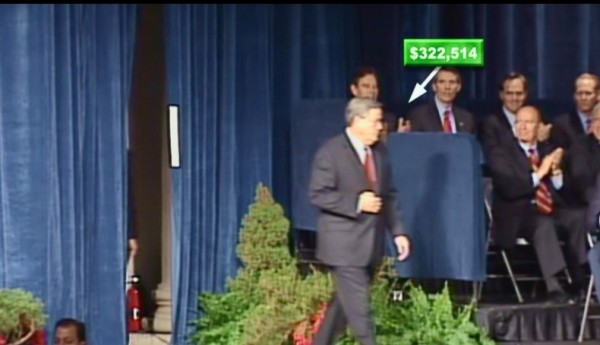

The president of MD Anderson is paid like someone running a

prosperous business. Ronald DePinho's total compensation

last year was $1,845,000.

That does not count outside

earnings derived from a much publicized waiver he received

from the university that, according to the Houston

Chronicle, allows DePinho to maintain unspecified "financial

ties with his three principal pharmaceutical companies."

DePinho's salary is nearly two and

a half times the $750,000 paid to Francisco Cigarroa, the

chancellor of entire University of Texas system, of which MD

Anderson is a part.

This pay structure is emblematic of

American medical economics and is reflected on campuses

across the U.S., where the president of a hospital or

hospital system associated with a university - whether it's

Texas, Stanford, Duke or Yale - is invariably paid much more

than the person in charge of the university.

|

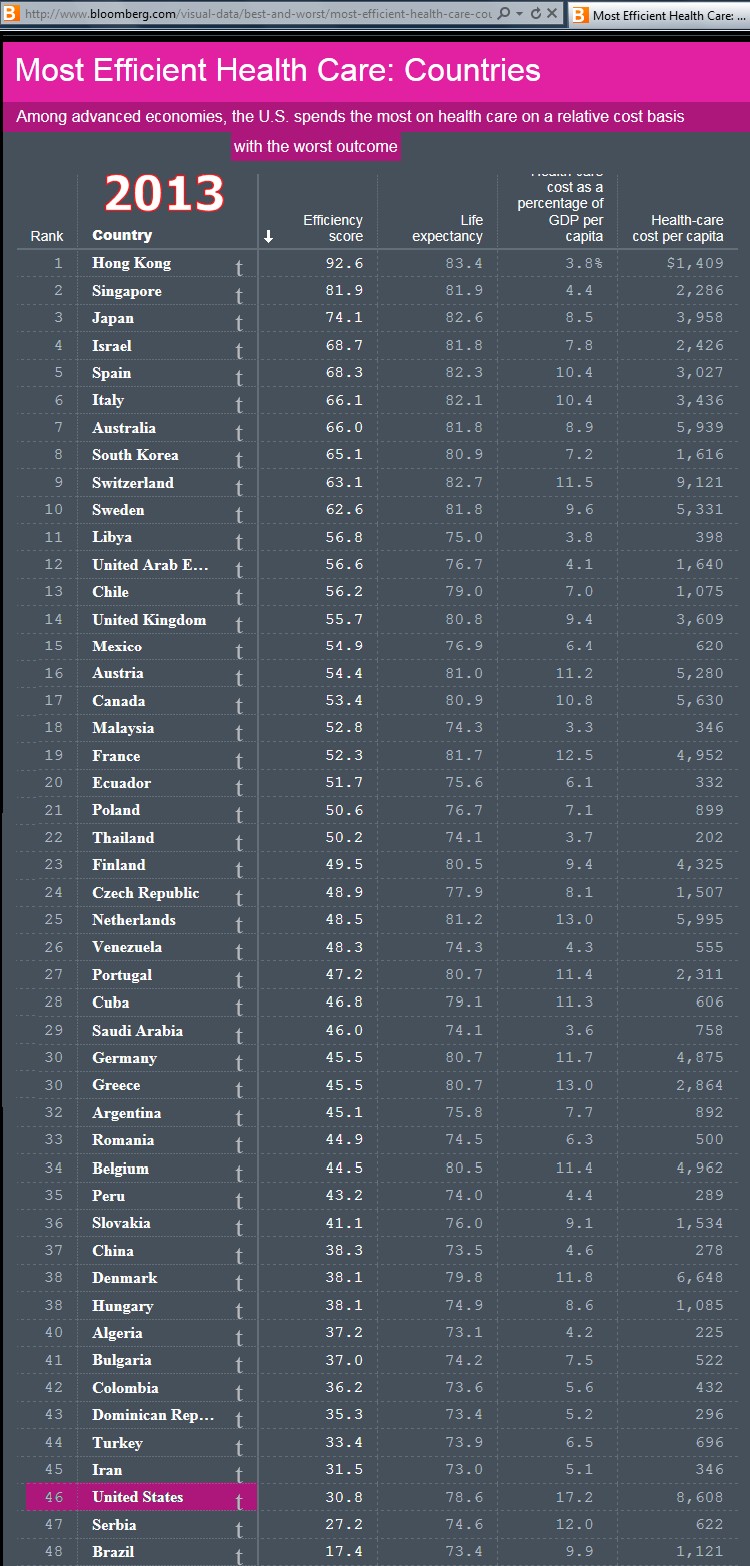

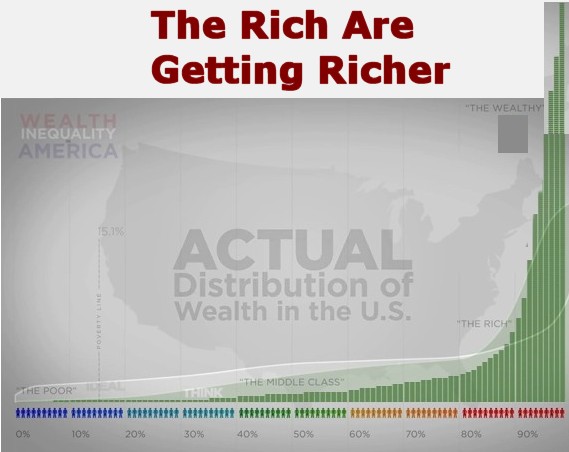

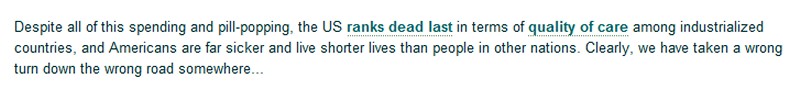

Rick Archer's Note: While you read

about the misery of Sean Recchi's dilemma - death,

bankruptcy, or both! - keep in mind that study after study

confirms the USA has one

of the most miserable health systems in the world.

Yes, it is true that if you are rich, you can get excellent

health care in America. But how many of us are rich?

According to this chart, only one country

in the world pays more per person than the USA. That

would be Switzerland. Before you feel too sorry for

Switzerland, this country is rated as one of the Top Ten

best health care systems in the world.

In the

USA, we

pay $8,608 per person. According to this chart, you could go

to Iran and get better treatment for $346.

17% of

our earnings go to medical care. No other nation is

even close!

It is

absurd to think how much we pay and how little we get in

return.

That

"$8,608 per person" is a legitimate statistic. At age

64, I pay $830 a month in insurance. That means I pay

close to $10,000 a year up front. That is a stiff

price for a person like me who is retired. THEN there

is the $2,500 deductible....

What

is darkly fascinating is that America is clearly slipping in

the rankings. In 2006, the USA was #37. Now we

are #46! All that hype about America with its finest

doctors, the finest hospitals, the greatest medical

schools... well, some of it may be true... but our actual

national system of medical delivery to the citizens is

completely and totally broken.

|

|

|

The Texas Medical Center

(Steven Brill's Article

continued)

Steven Brill, the

writer for Time Magazine:

I

got the idea for this

health care article when I was

visiting

Houston's Rice University last

year.

|

|

As I was leaving the

campus, which is just outside the central business district

of Houston, I noticed a group of glass skyscrapers about a

mile away lighting up the evening sky.

The scene looked like Dubai. I was looking

at the Texas Medical Center, a nearly 1,300-acre, 280-building

complex of hospitals and related medical facilities, of which MD

Anderson is the lead brand name.

Medicine had obviously become a huge business

in Houston. One look at that endless array of imposing

structures was all it took to make this clear.

In fact, of Houston's top 10 employers,

five are hospitals, including MD Anderson with 19,000 employees;

three, led by ExxonMobil with 14,000 employees, are energy

companies.

How did that happen, I wondered. Where's

all that money coming from? And where is it going?

|

Why

was Sean Recchi's bill so expensive?

(Brill's Article continued)

I have spent the past seven months trying

to find out by analyzing a variety of bills from hospitals like MD

Anderson, doctors, drug companies and every other player in the

American health care ecosystem.

When you look behind the bills that Sean Recchi and other

patients receive, you see nothing rational - no rhyme or reason -

about the costs they faced in a marketplace they enter through no

choice of their own. The only constant is the sticker shock for the

patients who are asked to pay.

Yet those who work in the health care industry and those who

argue over health care policy seem inured to the shock. When we

debate health care policy, we seem to jump right to the issue of who

should pay the bills.

While this is an

important question, it ignores what

should be the first

question:

Why exactly are the bills so high?

What are the reasons, good or bad, that cancer means a

half-million- or million-dollar tab? Why should a trip to the

emergency room for chest pains that turn out to be indigestion bring

a bill that can exceed the cost of a semester of college? What makes

a single dose of even the most wonderful wonder drug cost thousands

of dollars? Why does simple lab work done during a few days in a

hospital cost more than a car? And what is so different about the

medical ecosystem that causes technology advances to drive bills up

instead of down?

Recchi's bill and six others examined line by line for this

article offer a closeup window into what happens when powerless

buyers - whether they are people like Recchi or big health-insurance

companies - meet sellers in what is the ultimate seller's market.

The result is a uniquely American gold rush for those who

provide everything from wonder drugs to canes to high-tech implants

to CT scans to hospital bill-coding and collection services. In

hundreds of small and midsize cities across the country - from

Stamford, Conn., to Marlton, N.J., to Oklahoma City - the American

health care market has transformed tax-exempt "nonprofit" hospitals

into the towns' most profitable businesses and largest employers,

often presided over by the regions' most richly compensated

executives.

And in our largest cities, the system

offers lavish paychecks even to midlevel hospital managers, like the

14 administrators at New York City's Memorial Sloan-Kettering Cancer

Center who are paid over $500,000 a year, including six who make

over $1 million.

Taken as a whole, these powerful institutions and the bills

they churn out dominate the nation's economy and put demands on

taxpayers to a degree unequaled anywhere else on earth. In the U.S.,

people spend almost 20% of the gross domestic product on health

care, compared with about half that in most developed countries. Yet

in every measurable way, the results our health care system produces

are no better and often worse than the outcomes in those countries.

According to one of a series of exhaustive studies done by

the McKinsey & Co. consulting firm,

the USA spends more on health care

than the next 10 biggest spenders combined: Japan, Germany, France,

China, the U.K., Italy, Canada, Brazil, Spain and Australia.

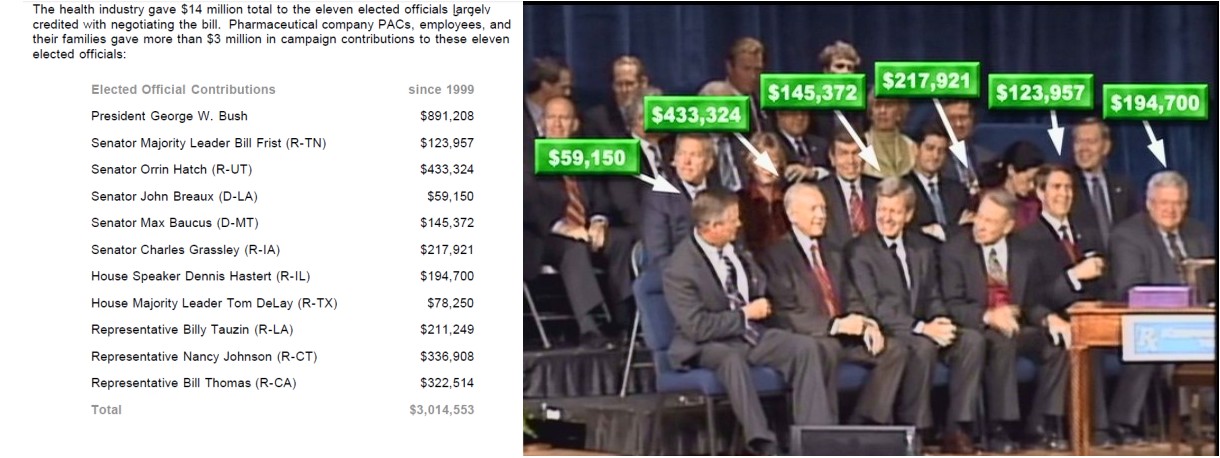

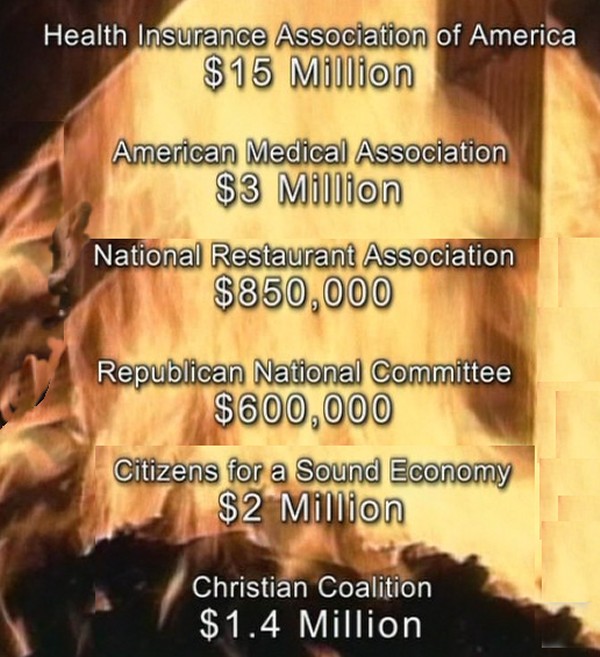

The Lobbyists and the Politicians

(Steven Brill's Article continued)

We may be shocked at the $60 billion price

tag for cleaning up after Hurricane Sandy.

Our nation spent almost that much last

week on health care... and then again and again

and again every week of the year. We spend more every year on

artificial knees and hips than what Hollywood collects at the box

office. We spend two or three times that much on durable medical

devices like canes and wheelchairs,

in part because a heavily lobbied Congress

forces Medicare to pay 25% to 75% more for this equipment than it

would cost at Walmart.

The Bureau of Labor Statistics projects that 10 of the 20

occupations that will grow the fastest in the U.S. by 2020 are

related to health care. America's largest city may be commonly

thought of as the world's financial-services capital, but of New

York's 18 largest private employers, eight are hospitals and four

are banks. Employing all those people in the cause of curing the

sick is, of course, not anything to be ashamed of. But the drag on

our overall economy that comes with taxpayers, employers and

consumers spending so much more than is spent in any other country

for the same product is unsustainable. Health care is eating away at

our economy and our treasury.

The health care industry seems to have the will and the means to

keep it that way. According to the Center for Responsive Politics,

the pharmaceutical and health-care-product industries, combined with

organizations representing doctors, hospitals, nursing homes, health

services and HMOs, have spent $5.36 billion since 1998 on lobbying

in Washington. That dwarfs the $1.53 billion spent by the defense

and aerospace industries and the $1.3 billion spent by oil and gas

interests over the same period. That's right: the

health-care-industrial complex spends more than three times what the

military-industrial complex spends in Washington.

When you crunch data compiled by McKinsey and other

researchers, the big picture looks like this:

Americans are likely to spend $2.8

trillion this year on health care.

That $2.8 trillion is likely to be $750

billion, or 27%, more than we would spend if we spent the same per

capita as other developed countries, even after adjusting for the

relatively high per capita income in the U.S. vs. those other

countries.

Of the total $2.8 trillion that will be

spent on health care, about $800 billion will be paid by the federal

government through the Medicare insurance program for the disabled

and those 65 and older and the Medicaid program, which provides care

for the poor. That $800 billion, which keeps rising far faster than

inflation and the gross domestic product, is what's driving the

federal deficit. The other $2 trillion will be paid mostly by

private health-insurance companies and individuals who have no

insurance or who will pay some portion of the bills covered by their

insurance. This is what's increasingly burdening businesses that pay

for their employees' health insurance and forcing individuals to pay

so much in out-of-pocket expenses.

|

The Effects of

Rising Health Care Costs

on Middle-Class Economic Security (source:

AARP)

Harriet Komisar

Georgetown University

EXECUTIVE SUMMARY

Health care costs, including costs for long-term services and

supports, are a growing burden for middle-class families across all

age groups. Wages have not kept up with increases in health care

costs, and more middle-class families are struggling to cope with

higher health insurance premiums and higher out-of-pocket expenses

when they have an illness. Rising health care costs are crowding out

other important priorities for workers, such as saving for their own

retirement or for their children's college

education.

Employers have responded to higher health

care costs by scaling back wage increases, shifting cost increases

to their employees, or changing the type of insurance they offer.

If these trends continue, many people who had been middle-class

throughout their working years will be at risk of not having enough

financial resources to maintain a middle-class lifestyle during

their retirement years. Increased out-of-pocket costs to Medicare

beneficiaries and the often catastrophic costs of long-term services

and supports are major threats to middle-class security for retirees

and family members, who often end up in caregiving roles.

Key Findings

This report documents the impact of rising health care and long-term

services and supports costs for middle-class workers and retirees.

Some key findings are as follows:

•

National health care

spending in the United States averaged $8,402 per person in

2010¡X72 percent higher than a decade earlier when it was

$4,878, and nearly triple the 1990 level of $2,854.

•

Health care spending has

been growing faster than inflation and the overall economy.

Between 2000 and 2010, health care spending per person grew at

an average rate of 5.6 percent per year, outpacing inflation

(2.4 percent per year) and the growth in gross domestic product

per person (2.9 percent per year).

• Over

the past decade, the average amount that middle-income

households spent on health care increased by 51 percent¡,

nearly double the growth in their incomes (30 percent)

and three times the rate of growth in their spending for all

other products and services.

•

With rising health

care costs, more people under 65 are burdened with high health

care spending. In 2009, 21 percent of middle-income people under

65 reported spending more than 10 percent of their incomes on

health care expenses, compared to 15 percent

of middle-income people in 2001.

•

One in five people are

in families that have problems paying medical bills. Many of

these families have experienced serious financial stress, such

as problems paying for other necessities (e.g., food, clothing,

and housing) or medically related bankruptcy.

•

Health insurance

premiums for employer-sponsored insurance nearly doubled over

the past decade, with total premiums (employers and workers

shares) increasing from an average of $7,601 per year in 2001 to

$15,073 in 2011 for family coverage. Rising premiums contributed

to a rise in the proportion of people without health insurance.

•

Employers have

responded to rising health care costs by shifting more health

insurance costs to employees, offering high-deductible health

plans with lower premiums but higher cost sharing, and limiting

wage growth.

•

Health-related

expenses absorb a large share of incomes for people age 65 and

older, and that share is projected to grow over time. The share

of household income spent on health care expenses is projected

to reach 18 percent for future retirees, compared to 8 percent

for today's retirees.

|

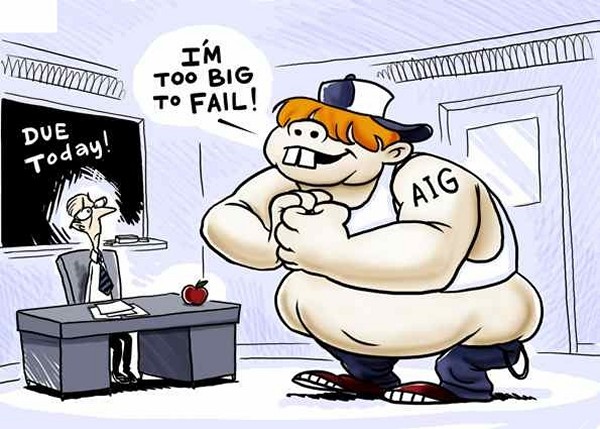

Whoever has the Gold, Makes

the Rules

|

Rick Archer's Note:

Are you depressed yet? Hey, I better

warn you: this article gets much worse.

Before I get into the specifics of how the

Twisted Golden Rule affects our medical system, first I need to

demonstrate how this rule is applied here in America. It

didn't take me long to find two examples of how the Twisted Golden

Rule works.

Twisted

Golden Rule, Example 1

2013:

Monsanto's Genetically Modified Wheat

"The strange case of

genetically engineered wheat on a farm in Oregon remains as

mysterious as ever. If anything, it's grown more baffling.

As we reported almost two months ago, the presence of this wheat

was revealed earlier this spring when a farmer in eastern Oregon

sprayed a field with the weedkiller glyphosate, or Roundup. Most

vegetation died, as the farmer intended, but clumps of green

wheat stalks kept growing. They apparently had sprouted from

grain that was leftover in the field from last year's crop.

It was such a strange sight that the farmer wondered if this

wheat might be genetically modified to be resistant to

glyphosate, just like the popular Roundup Ready versions of corn

and soybeans. He called a weed scientist named Carol

Mallory-Smith at Oregon State University to ask her opinion.

"I said I didn't think so," recalls Mallory-Smith. The biotech

company Monsanto had developed such wheat years earlier, and

carried out field trials of it, but those trials ended at least

eight years ago. Monsanto never asked for government approval to

sell such wheat, and growing it without a permit from the U.S.

Department of Agriculture actually would violate the law.

"So I was pretty skeptical, but I said, 'If you send me some

samples, I'll test it,' " Mallory-Smith says.

To her surprise the tests came back positive. She passed the

samples on to the USDA, which confirmed her results and launched

an investigation.

The USDA is trying to answer two big questions about this wheat.

First, where else can it be found? Second, how did it get into

this farmer's field?"

[Source:

NPR]

In May 2013,

genetically-modified (G.M.) wheat that was never approved for sale

inexplicably turned up in a field in Oregon. A farmer found the crop

when it miraculously survived a dousing of Roundup weedkiller.

Astounded by the crop's resistance, the farmer took samples to a lab

to be tested. The wheat was revealed to be an illegal strain.

The indestructible wheat had been genetically modified to resist pesticides by Monsanto,

the biotech corporation that owns the patents to both the pesticide

AND the genetically-modified wheat.

One of the new genes

inserted into Monsanto's G.M. wheat had made it resistant to the

herbicide Roundup Ready, which ironically is also manufactured by

Monsanto. (now isn't that curious??)

No one at Monsanto could

explain how this random crop of Roundup-resistant wheat showed up in

Oregon. It had been over ten years since Monsanto last tested

its wheat in the area. No normal seeds should last more than

two years, especially in a place like Oregon with hard winter

freezes.

Another strange

phenomenon is that 24 different strains of giant super-weeds seem to have

acquired a similar immunity to Roundup. In an eerie parallel

to the disease MRSA, a new strain of bacteria highly

resistant to some antibiotics, scientists wonder if the weeds have

developed their immunity by

somehow absorbing the same genes that Monsanto's G.M. wheat possess.

There remains a great

deal of suspicion towards G.M. food in the world community.

Europe wants nothing to do with it. Thanks in large part to

the French writer Marie-Monique Robin and her book The World

According to Monsanto: Pollution, Corruption, and the Control of the

World's Food Supply, many Europeans do not trust Monsanto. Neither does Japan and

South Korea. No one is quite sure just how safe or just how

dangerous this genetically altered wheat is. It could be

a ticking time bomb. It might take a generation or more for

any sinister effects to appear.

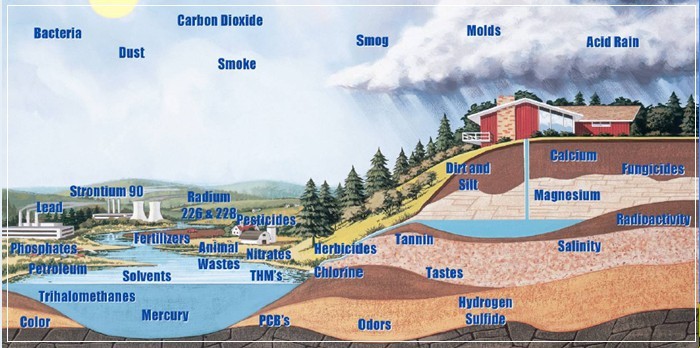

What people do know is

there is an increasing suspicion that America's widespread use of

toxic chemicals might be responsible for the growing rate of cancer.

When we ask our

doctors if these chemicals might be responsible for the

greater incidence, we are frequently told that "cancer is on the rise because people live longer

and cancer preys on the old".

Maybe so, but another

equally valid possibility might be the

pesticides on your food, chemicals that have been leaked into your

water AND soil AND air AND into your clothes

AND into your home, into your

household cleaning products and into the lotions and potions you spray

and rub onto your skin, and into the vaccines injected into your body.

|

|

"The numbing irony is that

the same corporations that produce carcinogenic chemicals,

including agricultural ones,

are also running the cancer treatment industry and selling

chemotherapy drugs.

Now that's what I call

vertical integration!"

- Ken Ausubel

|

In other words, when it

comes to any situation involving certain American chemical giants,

the trust level in the developed countries is not very high.

Sure enough, immediately after this illegal wheat discovery in

Oregon, Japan and South Korea cancelled enormous shipments of wheat

from Oregon, citing fears that the wheat crop could be tainted with

this suspicious seed.

Immediately farmers

across America reacted in anger because the price of wheat dropped

precipitously due to the bad news. Several lawsuits were filed

citing Monsanto's sloppiness in allowing this accident to happen,

thereby affecting their livelihood.

Monsanto dismissed the

lawsuit as “a wild swing that is unlikely to connect.”

Citing the fact that the wheat was growing randomly, like a weed, it

seems likely that this was a case of accidental contamination (or

perhaps deliberate sabotage), rather than a deliberate planting of

the illegal crop. “There was no negligence. Tractor-chasing

lawyers have prematurely filed suit without any evidence of fault

and in advance of the crop’s harvest,” said Monsanto’s general

counsel.

In the past, the USDA

has shown little sympathy for farmers whose crops have been

inadvertently contaminated by Monsanto. Last year, the agency

dismissed complaints by conventional and organic farmers that GM

seeds intermingle with their own strains, simply advising they buy

insurance to recoup their financial losses.

Humorist Stephen

Colbert had a "field day" with this news.

Calling the

strange crop "Zombie Wheat" because nothing could kill it

and it lived forever, he said the lyrics in "America the

Beautiful" would have to rewritten... “amber waves of

frankengrain”.

Then Colbert

suggested the networks release a sequel to the popular

"Walking Dead" series with "the Return of the Walking

Bread".

Colbert poked

fun at Monsanto for saying it is "mystified by the

appearance of the wheat", noting that "at this point, [the

wheat itself] can probably talk" and solve the mystery.

(Colbert

on Zombie Wheat)

|

|

On the same show,

Colbert hosted science journalist Laurie Garrett.

Ms. Garrett brought up a curious point when she pointed out that

Senator Roy Blount had introduced a bill called the Farmer Assurance

Provision that makes it impossible to sue manufacturers of

genetically modified crops. This law went into effect in March

two month prior to the strange Oregon wheat discovery.

Colbert, "So how

long does that law last?"

Garrett: "Six

months".

Colbert: "Are we

in the middle of that right now?

Garrett: "It

went into effect two months ago in March."

Colbert: "So

first this crop came out of nowhere and Monsanto said they

have no idea where it came from. And yet this crop just

happened to appear during the time where Monsanto got this

get out of jail free card?"

Garrett's

answer: "Go figure."

|

|

That's quite a

coincidence. Or maybe not.

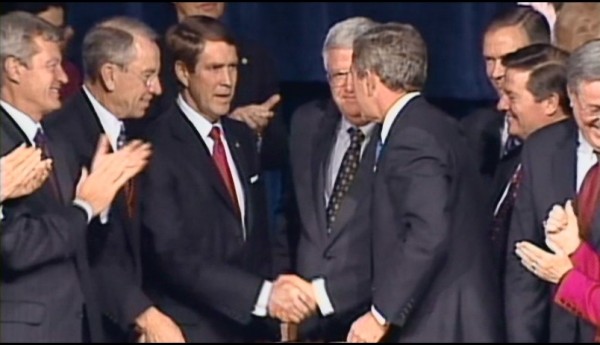

As it turns out,

Senator Roy Blunt is

considered to be Monsanto's "Man in

Washington".

Tom Philpott, writing

for the muckraking journal

Mother Jones, spoke of the same

bill that Laurie Garrett told Stephen Colbert about.

"A recent Senate

bill came with a nice bonus for the genetically modified seed

industry: a rider, wholly unrelated to the underlying bill, that

compels the USDA to ignore federal court decisions that block

the agency's approvals of new GM crops.

The admission shines

a light on Blunt's ties to Monsanto, whose office is located in

the senator's home state. According to OpenSecrets, Monsanto

first started contributing to Blunt back in 2008, when it handed

him $10,000. At that point, Blunt was serving in the House of

Representatives. In 2010, when Blunt successfully ran for the

Senate, Monsanto upped its contribution to $44,250. And in 2012,

the GMO seed/pesticide giant enriched Blunt's campaign war chest

by $64,250.

Blunt is also a magnet for PAC money from the agribusiness

industry as a whole, OpenSecrets data shows. In 2012, agribiz

PACs gave him $51,000—more than any other industry save for

finance, insurance, and real estate (FIRE). In 2010, the year of

his Senate run, agribiz PACs handed him over $243,000, more than

any other besides the FIRE and energy industries.

In a profile of

Blunt published the year before, the Washington Post's

Thomas B. Edsall wrote that Blunt had "converted what had been

an informal and ad hoc relationship between congressional

leaders and the Washington corporate and trade community into a

formal, institutionalized alliance." According to Edsall,

Blunt's relationship to the DC lobbying scene rivaled that of

DeLay's, who would later be hounded out of the House after being

indicted for ethical lapses.

Thomas Edsall writes

in the

Washington Post:

Both "Blunt

Inc." and "DeLay Inc." reflect the growing importance of

commanding multimillion-dollar funds and having reliable

loyalists in Washington's lobbying community. Blunt and

DeLay are fundraising powerhouses. Their political

organizations use multiple fundraising committees, have

rewarded family members and have provided an avenue to

riches for former aides now in the private sector.

"He Who Has the Gold, Makes the Rules"

- Ancient

Proverb

|

...........

The Twisted

Golden Rule, Example 2

2009:

The Texas Home That Crumbled

The story of Bob and

Jane Cull's fallen home took place in Mansfield, Texas, a well-to-do

suburb just south of Fort Worth.

The Culls were an upper middle class couple who had decided to build

their dream home next to a golf course. They were fortunate to have

the time and money to take five years searching for the perfect lot

to build on. They found the plans they wanted and hired a builder.

In 1996, they moved into their home and were very happy with it for

six weeks.

Then some serious

foundation problems began. When a main structural beam weakened,

they hired an engineer. The engineer told them the bad news -

their home was ruined. The Culls' new home was undergoing

"foundation heave."

The clay soil underneath

was expanding and contracting like a sponge as it got wet and dried

out. The edges of the foundation began lifting, and the wooden frame

began to bow under the stress.

The builder of their

home refused to correct the problem.

This began a 13-year odyssey.

The Culls hired a lawyer and

started legal proceedings against their former builder, Perry Homes.

They knew they faced an uphill struggle, especially in Texas.

In Texas, the legal system is never for the average person. Texas is

renowned to forgo legal protection to ensure a healthy business

climate.

In this case, the Culls

went to arbitration as the law demanded. They won and the builder

was instructed to pay the Culls a settlement of $800,000, remarkable

by Texas standards.

The homebuilder

refused to pay.

Bob Perry just happened to be the richest

and most politically connected builder in the state. Rather than pay

the settlement, he spent his money stalling. He abused the legal

process by appealing, and appealing, and appealing. He appealed for

years through the court system. The case finally ended up

before the Texas State Supreme Court, whose membership choose not to

recuse themselves despite what seemed to many to be a conflict of

interest. It should be noted that every member of the high

court had received contributions from Bob Perry — more than $260,000

from Bob Perry, his family and his political committees.

One has to wonder about

the impartiality of having one's case being judged by men who to

some extent owe their jobs to the man who appears before them.

The Texas Supreme Court

voted 5 to 4 to throw out the $800,000 Cull judgment, stating that

the case should not have gone to arbitration. By sending the case

back to district court in Fort Worth, in so doing, the Texas State

Supreme Court

overturned two lower courts and reversed 13 years of legal

decisions.

Hence, after 13 years

of court challenges, the Culls would now have to start the whole

process

again from scratch.

Imagine how disheartened

the Culls must have been. 13 years of neverending legal fees

and court manipulations for nothing. It was all down the

drain. Now they had to start over. These were not young

people either. They didn't have the luxury of waiting much

longer.

Further, even if they won

the next round, they

might possibly have to face a new state agency just created

by Governer Rick Perry. In a bizarre twist, this new agency

was headed by the SAME ATTORNEY hired by Perry Homes to appeal the Cull's

original

case.

Now how did that happen?

How did John Krugh, lead attorney become the head of the new regulatory

agency?

Bob Perry, Rick Perry -

Are they related? No, not by blood, but they are definitely

used to agreeing with one another.

So who is Bob Perry? (Bio) Back in 2004, Bob Perry was the largest single

contributor to "Swift Boat Veterans for Truth", the attack campaign

that sunk John Kerry's Presidential election bid.

And talk

about local Texas connections!

Since January 2000, Mr.

Perry donated more than $5.2 million to state candidates and causes,

making him by far the most prolific giver in Texas over that time,

according to campaign records reviewed by The Dallas Morning News.

Chunks of his money, coming sometimes in a flurry of $25,000 checks,

have gone to support anti-lawsuit, pro-business groups ($320,000)

and the state Republican Party ($980,000).

Last year, he provided $600,000 to 23 GOP candidates for the

Legislature, helping lift Republicans to their first takeover of the

Texas House since Reconstruction.

He also has given $175,000 to Gov. Rick Perry, $215,000 to Lt. Gov.

David Dewhurst and $437,500 to Attorney General Greg Abbott. He is

the largest individual contributor to almost every statewide

officeholder, all Republicans.

At the time of the Texas Supreme Court decision in 2009 involving

the Culls, Bob Perry was still contributing to the campaign funds of

Governor Rick Perry, the aforementioned various Texas State Supreme

Court candidates, and President George W. Bush as well. In

other words, Bob Perry knew the "right people".

Bob

Perry's maneuvers didn't stop there. The owner of Perry Homes was

able to lobby for and obtain passage by the Texas Legislature of a

law to ensure more protection for homebuilders. Not home

owners, but HOME BUILDERS. Yes, Bob Perry felt that

homebuilders needed more protection from frivolous homeowner

lawsuits. Fortunately, Governor Rick Perry heard Bob Perry's pain.

Rick Perry indeed created the very agency Bob Perry had asked for...

and installed Bob Perry's lawyer as the director.

A builder's best

friend: In June 2003

Governor Rick Perry helped push through a bill creating the

Texas Residential Construction Commission, a new government

agency that was supposed to protect homebuyers from unethical

builders.

In reality, the bill

was written by the housing industry with the help of John Krugh,

a lobbyist for the homebuilder and GOP money man Bob Perry (no

relation to Rick Perry). That September, after getting a $100,000 check from

Perry, Governor Rick Perry appointed John Krugh to the TRCC.

Consumer groups

fought back. After six years, they got the agency abolished in 2009.

[source:

Mother Jones]

The Culls were stunned.

13 years is a long time to see wasted, especially for

people who are retired and advancing in years.

The Culls had played by the

rules and gone through an arduous process as prescribed by law.

But the law had not worked for them even though they had a solid

case.

Why not? This strange decision had seemed drawn straight from the golden rule

playbook: "He who has the gold makes the rules."

Now what? For one

thing, now that 13 years had passed, the Culls could not possibly sell their home because it would not

pass inspection. Furthermore, their savings were so tapped out

with lawyer's fees they couldn't possibly afford the hundreds

of thousands of dollars needed to fix their dream home.

However, all was not

completely lost. Bob Perry was still not off the hook.

All the Texas Supreme Court had done was tell the Culls that the

arbitration decision was wrong; their decision had not vindicated

Bob Perry, but they had bought the man more time. If the Culls

wanted to start over, they were still welcome

to sue again in

the lower court.

And that is exactly what

they did. The Culls sued again. This time they

won. [source:

Georges Clark 2009]

2010

FOOTNOTE: Political moneyman Bob Perry ordered to pay $51

million

DALLAS

2010 – The Law Offices of Van Shaw announces a $51 million

jury verdict on behalf of a Mansfield , Texas, homeowner following a

13-year dispute with homebuilder Perry Homes to correct construction

defects to their home.

The jury agreed unanimously that Perry Homes acted knowingly and

intentionally, with “malice” and in bad faith in its dealings with

homeowners Bob and Jane Cull, who first complained of construction

defects shortly after they moved into their new home in 1996.

Additionally, jurors agreed that Warranty Underwriters Insurance

Company knowingly committed unfair and deceptive trade practices.

The panel found that the actions of both companies amounted to

fraud.

The unanimous verdict against Perry Homes and Warranty Underwriters

included a total of more than $14 million in actual damages and more

than $44 million in punitive damages.

The Culls were

represented by Van Shaw. Mr. Shaw says Perry Homes has aggressively

fought the Culls' claims and chose to spend far more to avoid blame

in this lawsuit than to properly address the Cull's initial

concerns. In 2002, the Culls were awarded $800,000 following an

arbitration hearing, but Perry Homes refused to pay and appealed the

award all the way to the Supreme Court of Texas, where all nine of

the justices have received campaign contributions from Perry Homes

president Bob Perry.

The fight between Perry

and the Culls underscores the difficulty that some homeowners have

in trying to get builders to fix their mistakes – especially

politically well-connected businessmen with deep pockets. The Culls

began their fight against Perry Homes a decade ago after cracks and

other problems developed in their $230,000 home in Mansfield. The

Culls said Perry Homes applied some cosmetic fixes, but didn’t

repair the house. Instead, Perry launched a long battle in court

that the Culls say was apparently designed to wear them down. Perry

is the biggest campaign contributor to Gov. Rick Perry, who has

supported the homebuilder’s efforts to limit lawsuits against

business and who helped create a state agency that critics say was

designed to protect homebuilders against complaints from homebuyers.

The Legislature last session abolished the agency.

“We're grateful that the

jurors in this case recognized the despicable treatment the Culls

suffered at the hands of Perry Homes and Warranty Underwriters,” Mr.

Shaw says. “Unfortunately, this kind of bullying treatment is not

unusual for homeowners trying to correct construction defects. I'm

hopeful that this verdict will send a message that homebuilders can

be held accountable for their actions.”

Rick Archer's Note: I think the story of the

defective home demonstrates clearly that whoever owns the gold makes

the rules... or, in the Cull case, at least tries to make

the rules.

However, here in

America, you never know... sometimes the underdog can still

win. And that is why there is still hope for our

country.

But how many

people have the deep pockets of the Culls or the tenacity to

stick to the fight for 13 years?

Most people I

know simply cower at the thought of being buried by these

tactics. The intimidation games played by the rich and

privileged are definitely nasty.

Isn't it strange

the games that rich people play?

It seems like Bob

Perry spent more money trying to avoid his

responsibility than he would have spent simply fixing the

problem in the Cull's

home in the first place.

It reminds us

again the extraordinary lengths certain people will go to win.

|

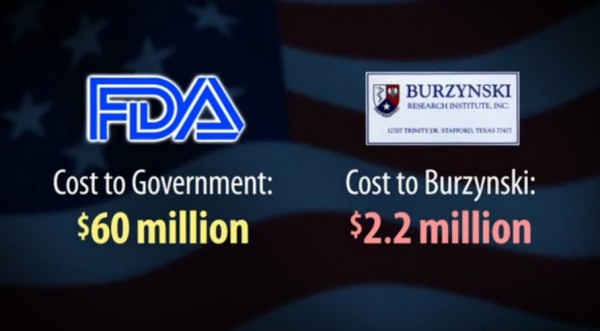

In 1996, the US Government spent $60

Million Dollars in a wasted attempt to convict cancer

researcher Stanislaw Burzynski on a crime. And what

was that crime? Burzynski had allowed his cancer

patients to take his cancer treatment home with them.

The government said this action violated Federal law.

(source)

|

| |

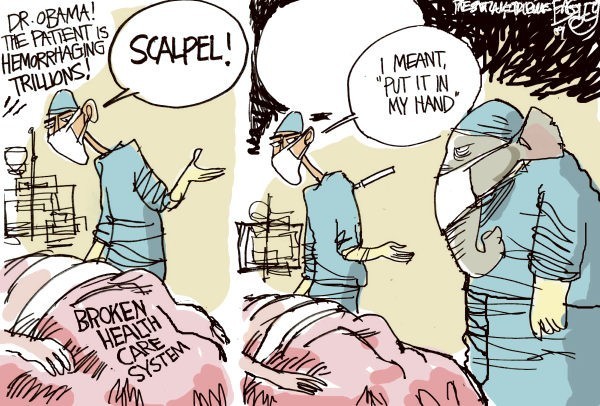

Sicko

|

Michael Moore's Documentary

on America's Health Care System

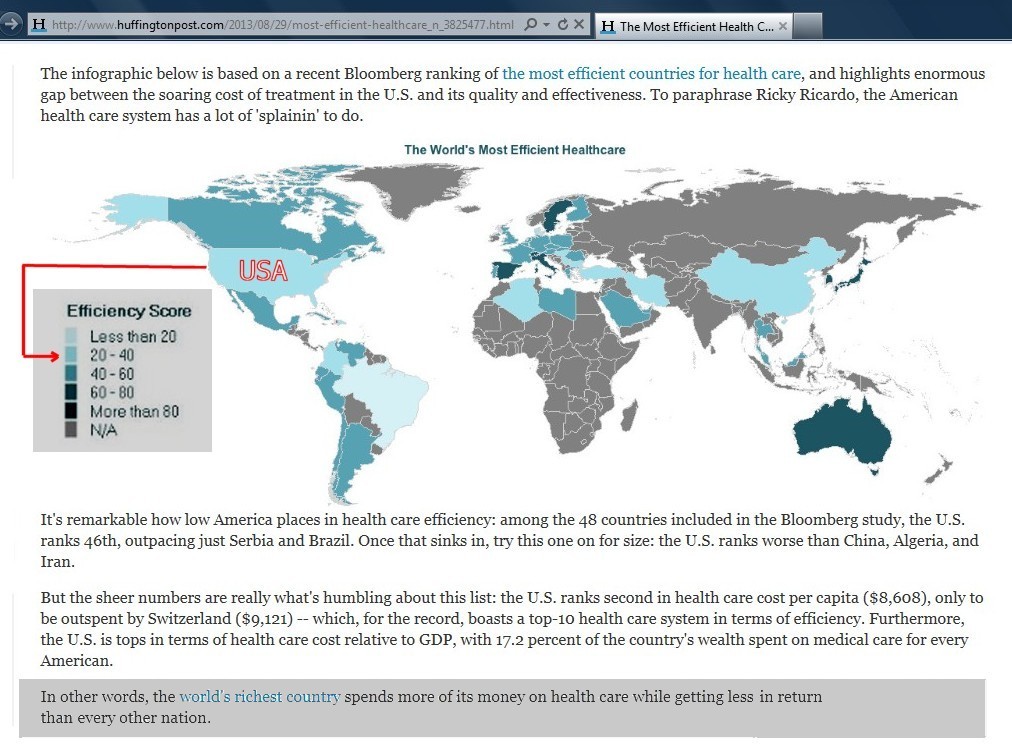

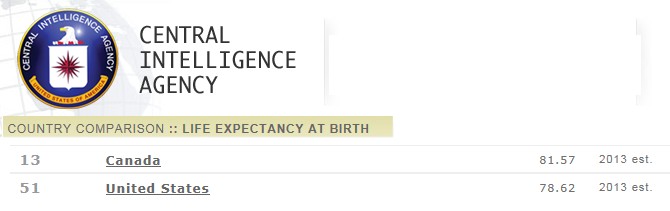

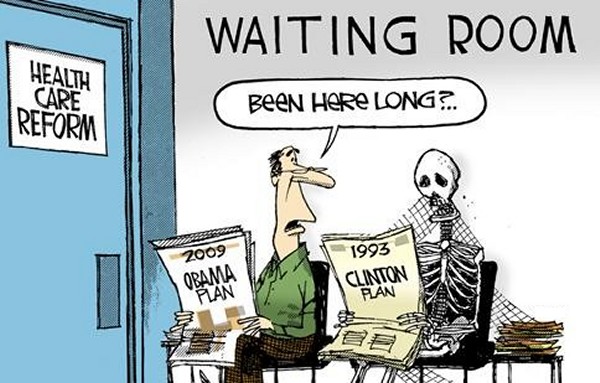

Rick Archer's

Note: We all know

something is wrong with America's Medical System. How

can a nation which spends as much money as the USA rank 46th

in the world for health care efficiency?

How can

America, the wealthiest nation in the world, a country which

spends more money per person than any other country, rank 51st in the world for

life expectancy? (CIA

data) Gee, if we want to live longer, does

this mean we should move to a poor country? Or

maybe we should just go to Canada. If we did, we would

probably live three more years. By the way, Canada

ranks 13th in the world.

It would be one thing

to pay top dollar if we received a superior medical system in

return.

But in America's case, well...

we don't get much in return. Something is

very wrong.

|

I honestly don't

feel like I have to twist the reader's arm to convince you

that our system is broken. Every single one of us has

some sort of bitter experience dealing with the American

medical system. The bitterness we all feel towards the

tactics of the health insurance companies is profound.

The exorbitant charges of the doctors and hospitals just

make our bitterness even worse.

For this section

of my article, I am going to turn to Michael Moore and his

documentary Sicko. I understand that many

people cannot stand Michael Moore. Be that as it may, when Moore speaks about our health care problem, the man makes sense.

I found several of Moore's arguments about what is wrong with

our medical system to be quite compelling. For your

own good, you should

at least hear what the man had to say.

Michael Moore

began his documentary with stories of people who did not

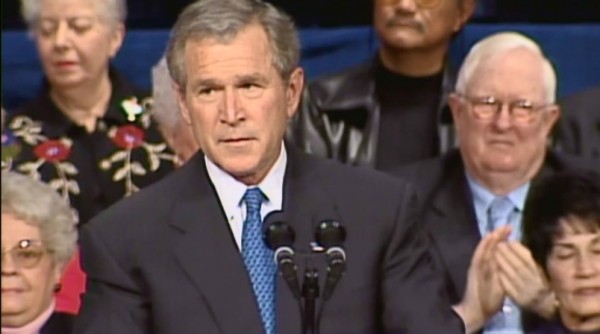

have health insurance to cover their injuries and illnesses.

Every one of these people were left devastated by the

astronomical medical cost they were faced with.

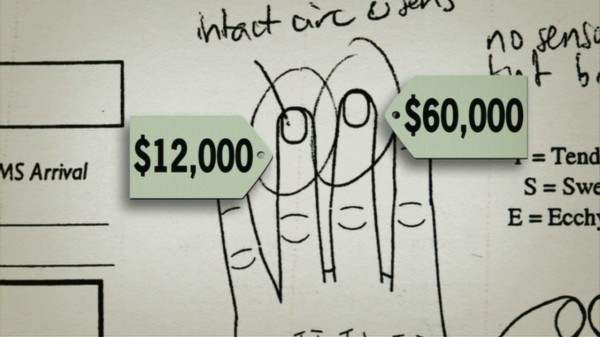

The case study

which caught my eye involved an Oregon man named Rick... not

me, of course, but another Rick... a Rick who somehow managed

to slice off the tops of two fingers while he used a power saw.

Rick

did not have

health coverage. So

the hospital gave him a choice.

1. Reattach the middle finger for

$60,000.

2. Do

the ring finger for $12,000.

Rick chose to reattach the ring

finger for the bargain price of 12

grand. He threw the middle finger

tip in

the dumpster.

There are 50 million Americans

with no health insurance.

Every day

they awake and

pray

they don't get sick.

Or they pray that don't have an accident like Rick from Oregon did.

Later in the

Sicko documentary, Michael Moore caught up with Brad, a

young Canadian who lives in London, Ontario.

Brad cut all

five fingers off in a power saw accident very similar to

Rick's. Brad explained that as the blade went through,

it caught the glove he was wearing and pulled his entire

hand over the blade which promptly sliced through the entire

group

of 5 fingers, completely severing every one of them from his

hand.

So now Moore went to interview the Canadian doctor who

performed the reattachment operation of all 5 fingers.

(Surgeon):

If you're looking at five fingers, you're looking at a

24-hour operation.

There actually were four surgeons, three plus myself, as

well as all the nurses.

We had two different anesthetists to carry out an

operation of that magnitude.

When Brad came in, we didn't have to worry about whether

he could afford it.

He needed help and we could concentrate on the best way

to bring him through it.

(Moore): Doctor, I

met this American named Rick. He had cut off the ends of two of his

fingers with a saw.

So when he arrived at the

hospital, they told him one finger's gonna cost $60,000,

and the other one was gonna be $12,000.

He had to choose which finger he could afford.

(Surgeon) We've never told someone that they

couldn't put a finger back on because the system

wouldn't allow it.

I'm very glad I work within a system that allows me the

freedom to look after people and not have to make

difficult choices like that.

|

|

The

Canadian Health System

To see what

Canadians thought of their health system, Michael Moore

drove over to a clinic. He interviewed several

different people in the waiting room. Here is the

transcript:

|

(Moore)

After meeting the doctor who reattached Brad's fingers,

it seemed nothing I had been told back in America about

the Canadian system was true.

Maybe I was just in

the wrong part of town. So I went across the city

to visit a crowded hospital waiting room. Except that it

wasn't very crowded.

There were

maybe 20 people in the room and most were more than

willing to speak to me on camera.

(Moore)

How long did you have to wait here to get help?

Patient 1 - 20 minutes.

Patient

2 - 45 minutes.

Patient 3

- I got helped right away.

Patient 4 - They really do an

amazing job.

(Moore) Did you

have to get permission to come to this hospital?

- No.

- No. We just drop in.

- We can go anywhere

we want.

(Moore) You don't have

to get the visit preapproved by your insurance company?

- Oh, heavens, no.

(Moore)

Can you choose your doctor?

- Oh, yes.

(Moore) What's

your deductible?

Patient 1 - Nothing.

Patient 2 - I don't

think we have any.

Patient 3 - I don't know.

Patient 4 - I don't think

there is any, as far as I know.

(Moore) So what

did this visit today cost?

Patient 1 - Nothing.

Patient 2 - We know

in America people pay for their healthcare, but I guess

we don't understand that because we don't have to deal

with that. And we're dealing with Parkinson's,

stroke, heart attack. We're very, very lucky. Really we

are.

I mean, we complain. People complain

about everything, right?

(Moore) Right, you're Canadian. That's goes

without saying.

-

But on the whole, it's a fabulous system for making sure

that the least of us and the best of us are taken care

of.

|

|

| Australia |

81.4 |

4.2 |

2.8 |

9.7 |

3,137 |

8.7 |

17.7 |

67.7 |

| Canada |

81.3 |

4.5 |

2.2 |

9.0 |

3,895 |

10.1 |

16.7 |

69.8 |

| France |

81.0 |

4.0 |

3.4 |

7.7 |

3,601 |

11.0 |

14.2 |

79.0 |

| Germany |

79.8 |

3.8 |

3.5 |

9.9 |

3,588 |

10.4 |

17.6 |

76.9 |

| Japan |

82.6 |

2.6 |

2.1 |

9.4 |

2,581 |

8.1 |

16.8 |

81.3 |

| Sweden |

81.0 |

2.5 |

3.6 |

10.8 |

3,323 |

9.1 |

13.6 |

81.7 |

| UK |

81.0 |

4.8 |

2.5 |

10.0 |

2,992 |

8.4 |

15.8 |

81.7 |

| USA |

78.1 |

6.9 |

2.4 |

10.6 |

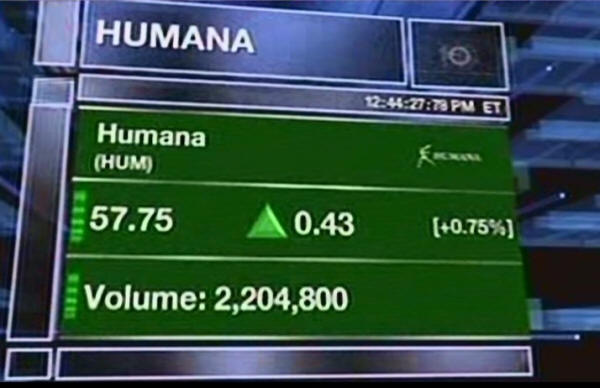

7,290 |

16.0 |

18.5 |

45.4 |

|

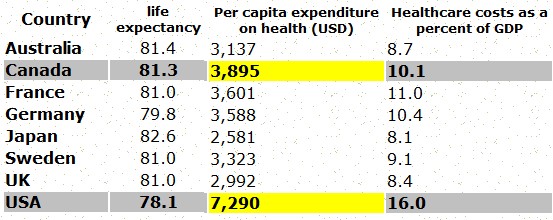

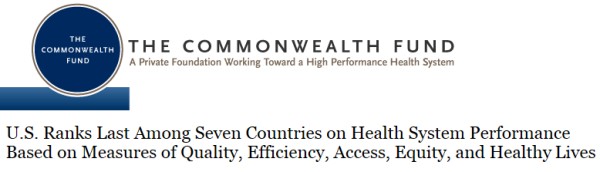

As one can see, this chart

from Year 2000 suggests that Canada's system is more

effective than our own.

The

"per capita expenditure on health" differential is the most

telling. The chart suggests that the USA spends nearly

twice as much money per person as Canada. 3,895

to 7,290 is quite a disparity.

Health care in Canada is delivered through a publicly funded

health care system, which is mostly free at the point of use

and has most services provided by private entities. It is

guided by the provisions of the Canada Health Act of 1984.

So

why is health care less expensive in Canada? The

Wikipedia article makes several suggestions.

Canada's provincially based Medicare systems are

cost-effective partly because of their administrative

simplicity. In each province each doctor handles the

insurance claim against the provincial insurer. There is no

need for the person who accesses health care to be involved

in billing and reclaim. Private health expenditure accounts

for 30% of health care financing.

Competitive

practices such as advertising are kept to a minimum, thus

maximizing the percentage of revenues that go directly

towards care.

In general,

costs are paid through funding from income taxes. In British

Columbia, taxation-based funding is supplemented by a fixed

monthly premium which is waived or reduced for those on low

incomes.

There are no

deductibles on basic health care and co-pays are extremely

low or non-existent (supplemental insurance such as Fair

Pharmacare may have deductibles, depending on income).

Family

physicians are chosen by individuals. If a patient wishes to

see a specialist or is counseled to see a specialist, a

referral can be made by a GP. Preventive care and early

detection are considered important and yearly checkups are

encouraged.

2012 saw a record year for number of doctors with 75,142.

The gross average salary was $328,000.

Canadians strongly support the health system's public rather

than for-profit private basis. A 2009 poll by Nanos

Research found 86.2% of Canadians surveyed supported or

strongly supported "public solutions to make our public

health care stronger."

A

Strategic Counsel survey found 91% of Canadians prefer their

healthcare system instead of a U.S. style system.

70%

of Canadians rated their system as working either "well" or

"very well". (Wikipedia)

|

Rick Archer's Note: In the

interest of fairness, I ran across an

article by John Stossel of Fox News that

strongly contradicts Michael Moore's rosy picture of

Canadian health care.

I suppose it all comes to

down to which source you choose to believe.

For example, the CIA says you will

live 3 years longer if you live in Canada. But who

would ever believe anything the CIA says? (CIA

data)

|

|

| |

Another Example of America's Broken Health Care System

After

surgery, $117,000 bill from doctor he never saw

By Elisabeth Rosenthal, NEW YORK TIMES

September 20, 2014

Surgical consultants have become the source of hefty

fees via what some in the industry call drive-by

doctoring.

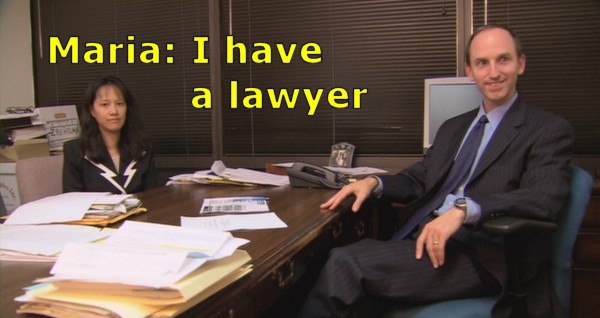

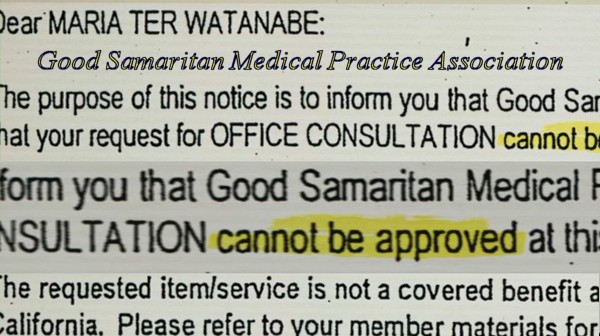

When Peter Drier, 37, agreed to surgery in December, he

was not in a good position to bargain or shop around.

Several weeks earlier, he had woken up to excruciating

pain in his upper back. A scan showed that one of the

disks that normally serve as cushions between vertebrae

was herniated and pushing on a nerve. He was living on

painkillers.

Before

his three-hour neck surgery for herniated disks in

December, Drier signed a pile of consent forms.

A bank technology

manager who had researched his insurance coverage, Drier

was prepared when the bills started arriving: $56,000

from Lenox Hill Hospital in Manhattan, $4,300 from the

anesthesiologist and even $133,000 from his orthopedist,

who he knew would accept a fraction of that fee.

He was blindsided, though, by a bill of about $117,000

from an "assistant surgeon," a neurosurgeon based in

Queens, N.Y., whom Drier had never met.

"I thought I understood the risks," Drier, who lives in

New York City, said later. "But this was just so wrong -

I had no choice and no negotiating power."

Drive-by doctoring

In operating rooms and on hospital wards across the

country, physicians and other health providers typically

help one another in patient care.

But in an increasingly common practice that some medical

experts call drive-by doctoring, assistants, consultants

and other hospital employees are charging patients or

their insurers hefty fees. They may be called in when

the need for them is questionable. And patients usually

do not realize they have been involved or are charging

until the bill arrives.

The practice increases revenue for physicians and other

health care workers at a time when insurers are cutting

down reimbursement for many services. The surprise

charges can be especially significant because, as in

Drier's case, they may involve out-of-network providers

who bill 20 to 40 times the usual local rates and often

collect the full amount, or a substantial portion.

"The notion is you can make end runs around price

controls by increasing the number of things you do and

bill for," said Dr. Darshak Sanghavi, a health policy

expert at the Brookings Institution until recently. This

contributes to the nation's $2.8 trillion in annual

health costs.

Insurers, saying the surprise charges have proliferated,

have filed lawsuits challenging them. Multiple state

health insurance commissioners have tried to limit

patients' liability, but lobbying by the health care

industry sometimes stymies their efforts.

"This has gotten really bad, and it's wrong," said James

Donelon, the Republican insurance commissioner of

Louisiana. "But when you try to address it as a

policymaker, you run into a hornet's nest of financial

interests."

In Drier's case, the primary surgeon, Dr. Nathaniel

Tindel, had said he would accept a negotiated fee

determined through Drier's insurance company, which

ended up being about $6,200. (Drier had to pay $3,000 of

that to meet his deductible.)

But the assistant, Dr. Harrison Mu, was out of network

and sent the $117,000 bill. Insurance experts say

surgeons and assistants sometimes share proceeds from

operations, but Tindel's office says he and Mu do not.

Mu's office did not respond to requests for comment.

The phenomenon can take many forms. In some instances, a

patient may be lying on a gurney in the emergency room

or in a hospital bed, unaware that all of the people in

white coats or scrubs who turn up at the bedside will

charge for their services.

Can't fight back

At times, a fully trained physician is called in when a

resident or a nurse, who would not charge, would have

sufficed. Services that were once included in the daily

hospital rate are now often provided by contractors, and

even many emergency rooms are staffed by out-of-network

physicians who bill separately.

When insurers intervene in a particular case, they say

they have limited ability to fight back. Insurance

examiners "are not in the room on the day of surgery to

see the second surgeon walk into the room or why they

were needed," said Clare Krusing, a spokeswoman for

America's Health Insurance Plans, an industry group. And

current laws do not require hospitals that join an

insurance network to provide in-network doctors, labs or

X-rays, for example.

When Drier complained to his insurer, the company cut a

check to Mu for $116,862, the full amount.

So sometimes insurers just pay - to protect their

customers, they say - which encourages the practice.

(Source)

Two

Letters to the Editor regarding the Peter Drier

Story

Broken system

Regarding "'Drive-by' doctors add shock to bills"

(Page A4, Sunday), for many of us, our medical

system seems like legalized theft. Granted, we have

the best care in the world; however, there seems to

be a lack of ethics in the quest for money.

As your article showed, doctors apparently think

nothing of dropping in on surgery and then charging

$39,000 per hour to "assist."

In this

Peter Drier example, the actual doctor

performing the three-hour surgery agreed to operate

for $6,200 total, while the "drive-by" doctor made

$117,000 for dropping in and assisting, with the

patient having no prior knowledge, or consenting to

this.

This is similar to asking your insurance company

what a procedure will cost at a doctor's office and

being told either $40 or $1,800 depending on how

it's coded. Or getting a bill from a doctor's office

for $1,700 after having the receptionist tell you

"don't worry it's just a $40 co-pay." Or having the

ambulance service call and say you owed $1,000 for a

trip to the hospital and then you tell them you paid

$600 months ago and they say thanks and hang up.

These are just some of the experiences my family has

had. This medical system is broken, the bureaucracy

makes it impossible to get a straight, honest

answer, and the costs are outrageous.

It would be nice if some of these doctors and

insurance companies were called on the carpet for

some of these types of behaviors.

Mike

Donnelly, Pearland, Texas

Punish predators

The story of hospitals, doctors and other health

care providers sneaking outrageous overcharges into

bills for medical procedures and services is

certainly not a new one.

The natural outcome of this practice would be the

blatant disregard for simple humanity demonstrated

by the "assistant surgeon" told of in the story, a

predator who literally snuck in the back door -

unbidden, unwanted and unneeded - to add $117,000 to

the patient's bill. To say that this practice is

fraudulent is an understatement, which raises the

question: Why are the people who do things like this

not in jail?

Pete Smith, Houston,

Texas

Rick Archer Note: As one can gather, the

insurance company passes on the additional cost to the

consumer who now pays increasingly higher healthcare

premiums. We speak of how "capitalism" drives down

costs through increasted efficiency, but in the world of

healthcare there seem to be no market forces in operation.

And why is that? The answer of course is the

Twisted Golden Rule. Not only do the doctors, the

lawyers, and the health insurance companies all have the

politicians in their pocket, there doesn't seem to be much

you or I can do about it.

You don't believe me? Well, read on and see what you

think.

|

| |

Socialism versus Capitalism

I understand

very clearly that the word "socialism" has deeply negative

connotations here in America.

That said, based

on Michael Moore's documentary, I came to the conclusion

that the

"socialist" Canadian health system is far superior to the

American health system. For that matter, based on what

was shown in the documentary, I concluded that the "socialist"

English health system and the "socialist" French health

system are also superior to the American system.

I am no "enemy"

of the capitalist system. I understand that the

capitalist model of seeking excellence through competition

has its virtues. I also understand the value of an

incentive. Any man will work harder if he expects a

reward for his hard work and the right to keep the fruit of

his efforts.

I myself have

been well rewarded for pursuing the capitalist dream.

Many years ago, I had an original idea that a dance studio

could emphasize group dance lessons over the traditional

"private lesson" model that was the established business

practice at the time.

I parlayed this

idea into creating the largest social dance studio in the

country. As a successful businessman, I paid salaries,

I paid rent, I paid taxes, I paid insurance, I paid health

care, and I worked damn hard every step of the way for

thirty years.

I think this

experience qualifies me as a card-carrying member of the

American business community.

When it

comes to taxes, I am no different than anyone else - I hate

taxes. Like everyone else, I do not enjoy seeing taxes take a huge cut out

of my earnings. Today I pay $20,000 a year in property

taxes alone. I continue to work well past retirement age

simply in order to pay those property taxes. And do you think I

am alone? Many other Americans continue to work well past

retirement age for the exact same reason.

So I understand

why everyone fears any "socialist" medical system that would

take an even larger cut out of our earnings.

But what

if a "socialist" medical system turned out to be

more cost-effective? Let's look at that

chart again.

Unless

that chart is lying to us ... look for yourself in

Wikipedia... American citizens pay far more

than the evil "socialist" systems and get far less

in return!

Think

about it. The American health care system is

the laughingstock of the entire world. How can

anyone look at that chart and not wonder if there is

a possibility that the American people have been

fooled on this issue??

|

|

Furthermore, I want the

reader to understand something else. Everyone screams about

the evils of Obamacare, but most people don't realize

they are already paying a hidden health care tax.

As the number of

Americans without health insurance continues to rise, so too

do the costs borne by those who have coverage. The

people with insurance face what might be called a "hidden

health tax." Private health insurance premiums are higher,

at least in part, because uninsured people who receive

health care often cannot afford to pay the full amount

themselves. The costs of this uncompensated care are shifted

to those who have insurance, ultimately resulting in higher

insurance premiums for businesses and families.

When the uninsured do obtain care, they struggle to pay as

much as they can afford. Often, however, the uninsured

cannot afford to pay the entire bill, and a portion of it

goes uncompensated. To make up for these uncompensated care

costs, doctors and hospitals charge insurers more for the

services provided to patients who do have health coverage.

In turn, the costs that are shifted to insurers are passed

on in the form of higher premiums to consumers and

businesses that purchase health coverage. (source)

This cost shift to health insurance premiums is a "hidden

health tax." In other words, if you are insured, you

are already funding the poor. Why not just shift to a

universal health care system and level the entire playing

field just like every other civilized country in the world?

They say if it

ain't broke, don't fix it. Well, my dear readers, our

American health care system is broken.

It isn't just

broken, it is broken badly. We have to do something.

I happen to

think the "socialist" Canadian health system, English health

system, and French health system are all superior to the

American health system. And those systems aren't just

"a little bit

better"... I say those health systems are vastly superior.

|

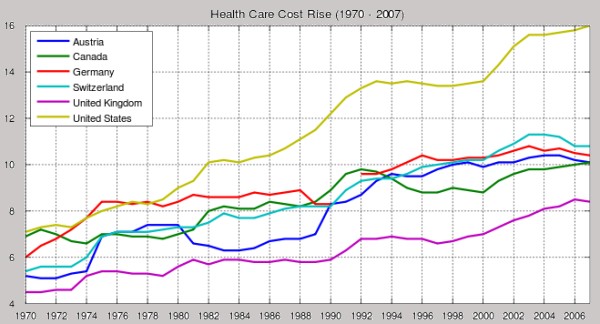

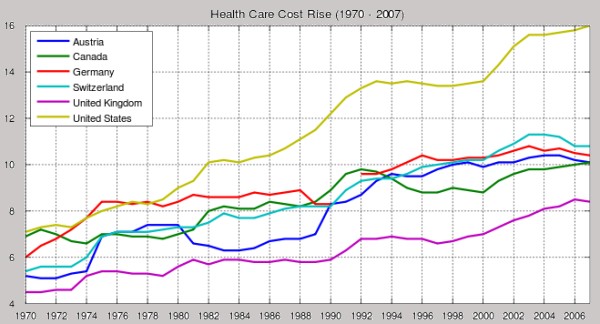

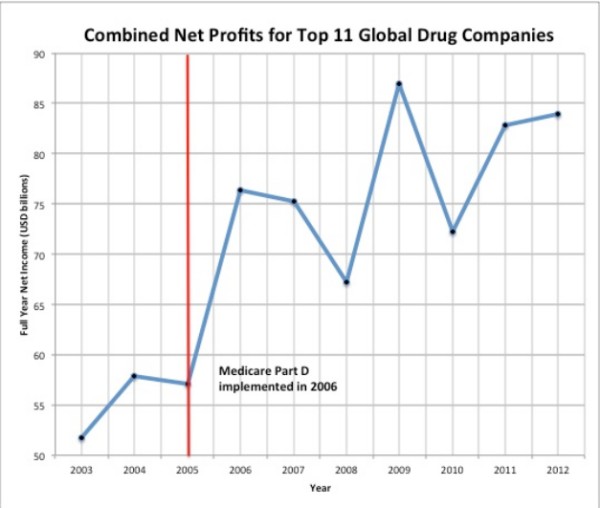

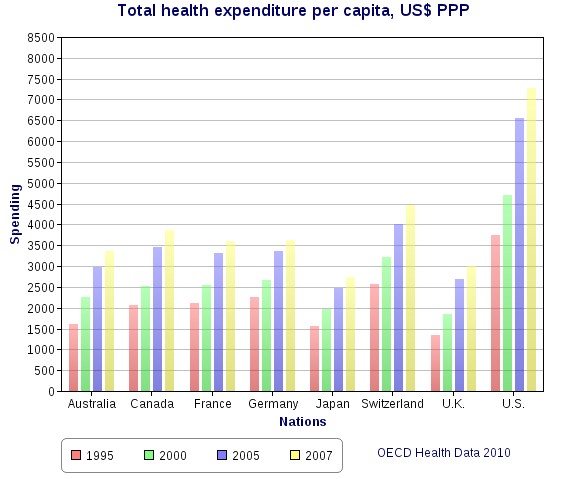

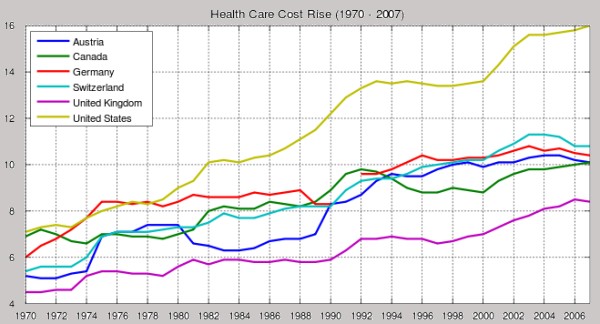

Take a quick

look at that chart. That chart is not Michael Moore

propaganda. That chart is from

Wikipedia, heretofore a staunch defender of the

American Medical Association.

The chart shows

quite clearly that something badly went wrong with our

health system starting around 1978. The chart also

shows that things really began to spiral even more out of

control in 2004. Although the chart ends at

2007, we all know that things have only gotten worse since

then.

It is beyond

pathetic for American citizens to pay the most money of any

society in the world and yet have our system ranked among

the most mediocre.

How could things have gotten this

bad?

I am hardly an

expert, but I have my suspicions. For starters, I

happen to think that "Capitalism" is the wrong approach to

health care.

And now I will

make my case.

|

As one

can readily see, health costs in the USA are rising much

faster than in other countries.

Wikipedia

|

|

The

Role of Government

Whether is it

the central government or the local government, I think we

can all agree there are certain areas that belong

in the hands of centralized authority.

High on the list

is National Defense. On the local level we have

the police and the fire department. Then we have

education, but local and national. Then there are roads and infrastructure

that must be built and maintained.

Let's not forget

about Social Security. Or Medicare. Or the other

social safety net programs like unemployment benefits, welfare

payments, and food stamps.

And let us not

forget about NASA. For defense reasons and the

advancement of mankind, this program is a vital part of our

NATIONAL identity. NASA is an integral part of being

American.

Each citizen

helps to pay for these things through tax dollars.

Now I understand

that the government spends too much. Yes, I get that.

No argument from me. And like any household that

overspends, arguments must be raised as to where to cut back

or how to find more money. I completely agree that

government spending is out of control. But this is an

issue for a different article; let's stick to healthcare for

now.

My point is

simply this: we all seem to agree that at least some

"collective" things are better left to the government.

And I think

healthcare is one of them...

Why? Because

when a medical plan attempts to make "profit" off "health

care", the customer generally gets short-changed.

You and I are

the customer. We are being short-changed.

|

|

| |

|

Profit Over People -

Patient Dumping

Note: "Patient

dumping" is the transfer of a patient from one hospital

(typically a private hospital) to a public hospital because

of the patient's lack of insurance or inability to pay. The

uninsured are the most vulnerable to patient dumping. This

deplorable practice is one of the truly disgusting

features of our "capitalism-based" medical system.

|

Video Catches Hospital 'Dumping' Incident

by Ina Jaffe,

NPR

2006 - For many months, Los

Angeles city officials have complained that regional

hospitals are dropping off their indigent patients in the

city's tough Skid Row area. On Wednesday, officials at a

homeless shelter released a videotape that allegedly catches

one hospital in the act. The incident has become part of an

ongoing investigation that could result in criminal or civil

penalties.

Security cameras outside the Union Rescue Mission, the

city's largest homeless shelter, show a taxi pulling a

U-turn in front of the building. Several seconds later, an

elderly woman in a hospital gown shuffles into view. She

appears to have only hospital socks on her feet, and walks

in the street for a while before turning back to the mission

entrance.

Mission worker Regina Chambers met the woman outside, later

identified as Carol Reyes, a homeless resident of the city

of Gardena, a dozen miles south of downtown Los Angeles.

"When I first approached her, she was very disoriented,

didn't know where she was or what she was doing," Chambers

says. "All she knew is that she had been to a hospital."

It was later determined that Reyes was released from

Kaiser Permanente hospital, a

privately-owned facility in the city of Bellflower, 16

miles southeast of the mission.

Los Angeles goes

after Vegas hospital for dumping 1500 patients

USA Today

May 20, 2013 18:43

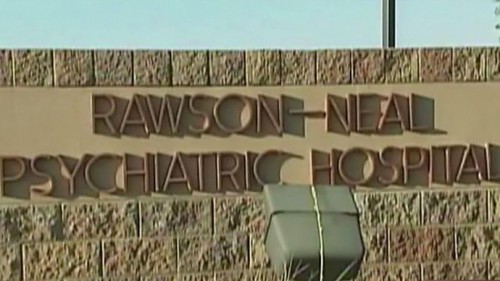

The city of Los Angeles is pursuing a criminal investigation

of a psychiatric hospital in Las Vegas, which has allegedly

put 1,500 patients on buses and sent them out of state over

the past five years.

About one third of these patients, some of which were

homeless, were given one-way bus tickets to cities in

California. About 200 of the 1,500 mentally ill patients

were sent to Los Angeles County, 150 of whom arrived in

downtown L.A. Since 2008, patients were bused to cities in

every continental US state, even though some had no family,

friends or housing at their destination. After the

Sacramento Bee published an exposé on the dumping practices

of the Rawson-Neal Psychiatric Hospital, the city of

Los Angeles announced it would launch a probe investigating

the matter.

“It’s just an abhorrent practice,” Gil Cedhillo, a candidate

for the L.A. City Council and a former state senator, told

the Bee. “You can’t just take someone from a facility and

dump them downtown.”

L.A. has one of the strictest patient-dumping laws in the

US, which was adopted in 2007 after a homeless schizophrenic

was found walking the streets in his hospital gown while

still connected to a catheter bag.

The Bee obtained bus receipts from the Nevada Division of

Mental Health and Developmental Services and found that the

hospital sent its patients away on Greyhound buses, equipped

with a small supply of medication and several bottles of a

nutritional supplement that only lasted a few days.

Health officials claim that most of the patients were sent

off to cities where they had a place to stay, but the Bee

discovered several cases in which mentally ill patients were

forced to go to cities that they had no connection to.

One example would be James Flavy Coy Brown, a

48-year-old homeless man who had received treatment at

Rawson-Neal.

Brown

was put on a bus that dropped him off in Sacramento – even

though he had never been there and knew no one in the city.

The former psychosis patient had only been treated

for three days before doctors sent him out of state, despite

his protests.

Equipped with a $306 one-way bus ticket, six Ensure

nutrition shake bottles, and a three-day supply of

psychiatric medications, he was sent away, only to end up on

the streets of Sacramento – without medication.

The man had no Social Security

card, food stamp card or Medicaid card, and checked into a

homeless shelter, feeling the effects of medication

withdrawal and the return of his psychosis.